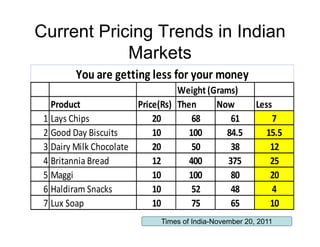

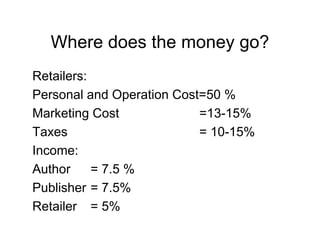

This document discusses various aspects of pricing decisions and strategies. It covers the importance of pricing, factors that affect pricing both internally and externally, pricing objectives, approaches such as cost-based, demand-based and competition-based pricing. It also discusses concepts like break-even analysis, price adjustments strategies including promotional pricing, geographical pricing and price discrimination. Overall, the document provides an overview of key considerations and methods involved in setting prices for products and services.