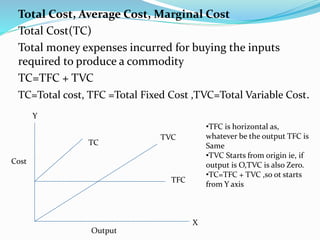

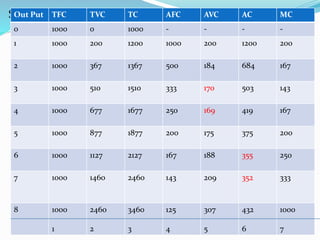

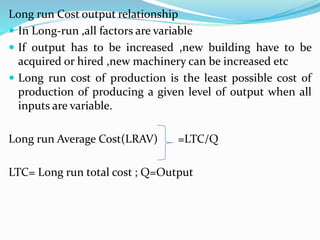

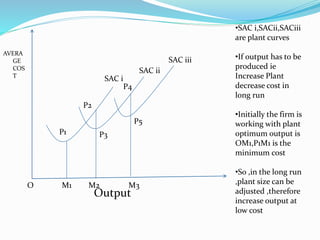

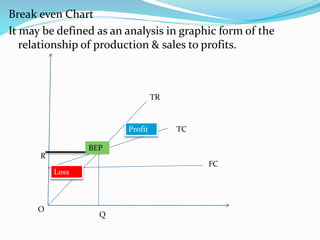

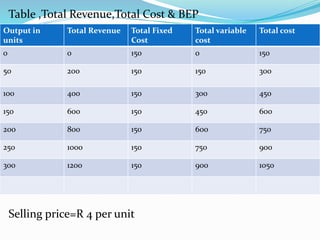

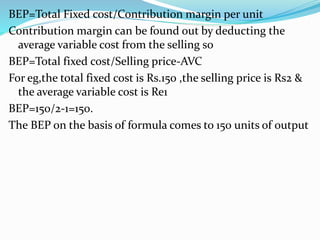

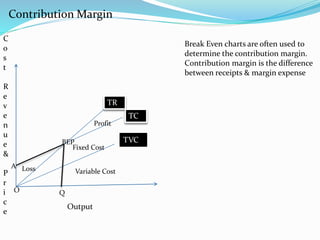

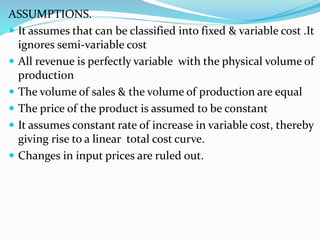

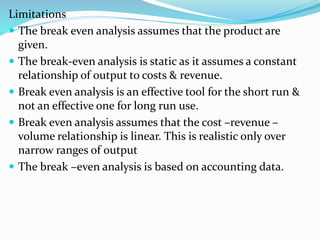

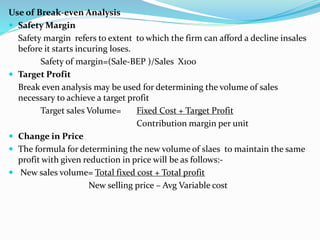

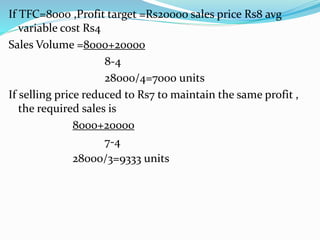

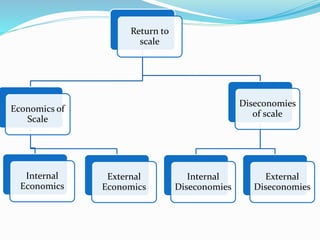

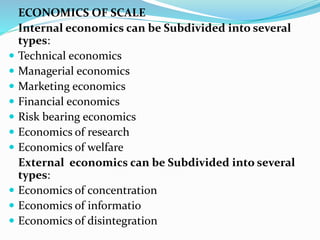

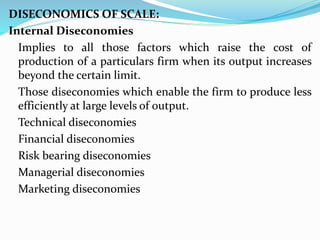

The document provides an overview of managerial economics focusing on cost and production analysis, detailing various cost concepts and their relevance to business operations. It covers break-even analysis, cost control, and the implications of economies of scale, highlighting the relationships between cost, output, and profitability. Additionally, it discusses techniques for cost reduction and the importance of understanding production costs for effective decision-making in business.