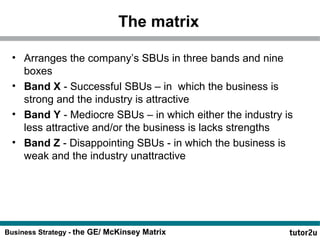

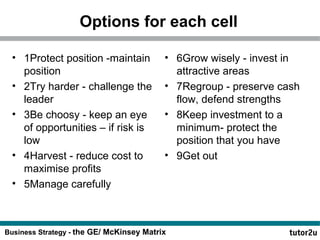

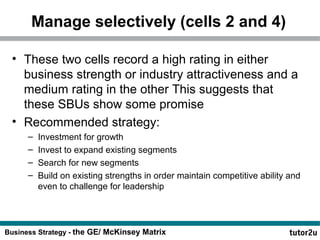

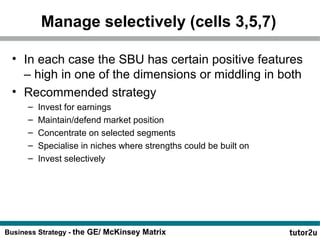

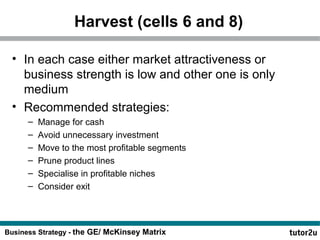

The GE/McKinsey Matrix is a portfolio analysis tool used to classify business units within a large company based on two criteria: industry attractiveness and business unit strength. It evaluates each unit and places it in one of nine cells based on its criteria scores, recommending different strategies for units in each cell ranging from investing for growth to harvesting or divesting.