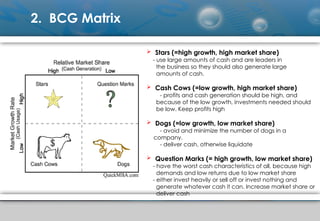

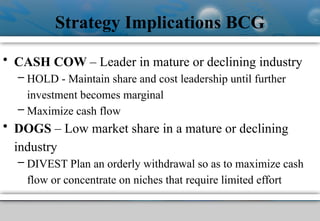

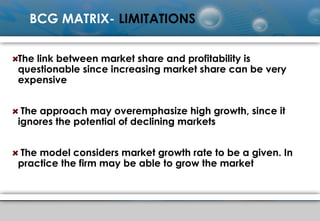

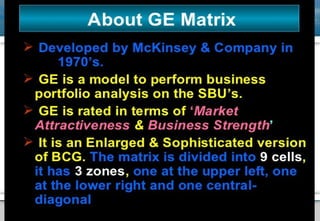

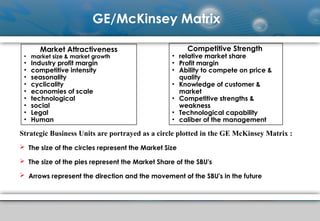

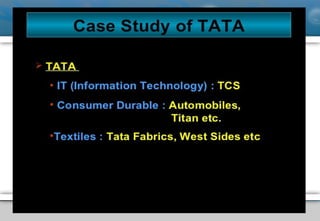

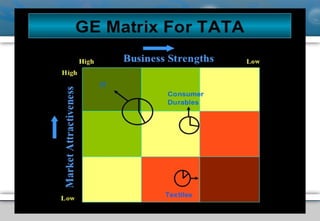

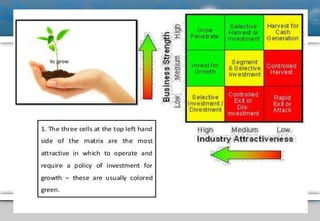

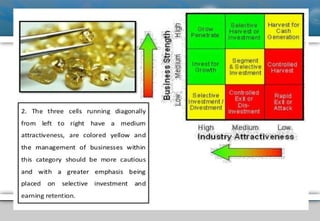

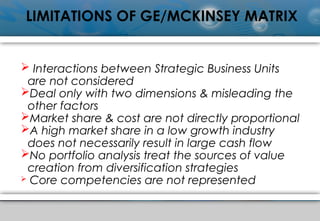

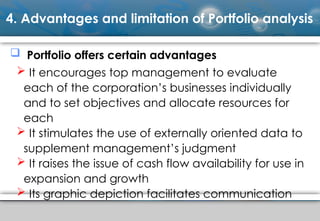

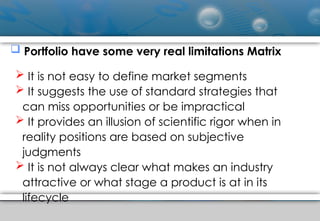

The document discusses portfolio analysis using frameworks like the BCG and GE/McKinsey matrices. It outlines the purpose of portfolio analysis, which includes evaluating strategic business units (SBUs) for investment and growth strategies, while explaining the characteristics of stars, cash cows, dogs, and question marks. Limitations and advantages of these matrices are also highlighted, emphasizing the need for a nuanced approach to industry attractiveness and competitive strength.