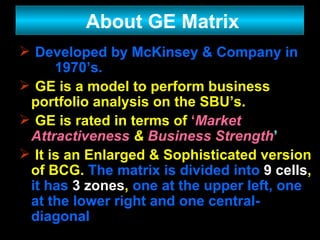

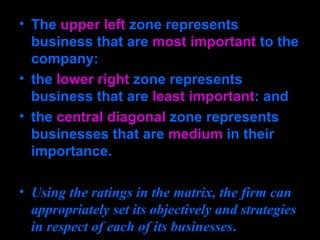

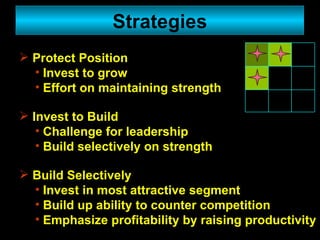

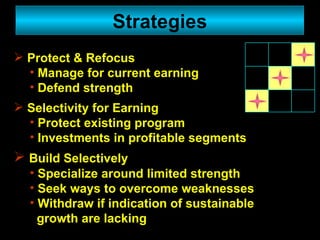

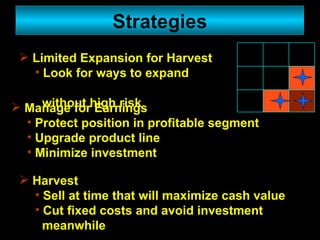

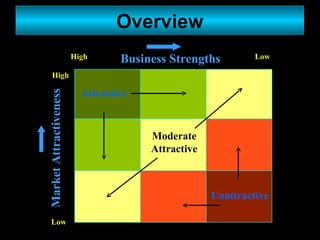

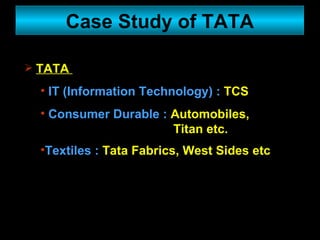

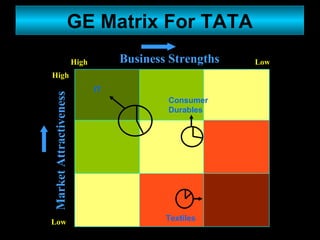

The document discusses General Electric's (GE) matrix for strategic portfolio analysis and classification of business units. The GE matrix analyzes each business unit based on its market attractiveness and the company's business strength in that unit. It divides the portfolio into 9 cells based on these factors. The upper left zone contains the most important businesses, the lower right the least important, and the center diagonal zone houses medium importance businesses. The matrix provides a framework for objectively setting strategies for each business unit based on its classification.