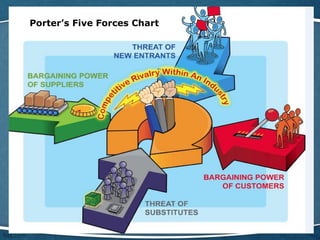

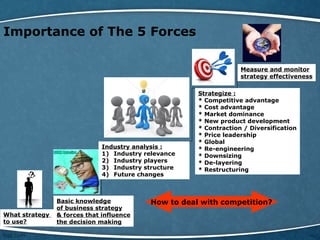

Porter's Five Forces is a model for industry analysis that examines five competitive forces that shape every industry. The five forces are: the threat of new entrants, the threat of substitutes, the bargaining power of suppliers, the bargaining power of customers, and the intensity of rivalry among existing competitors. The model helps understand the attractiveness of an industry and the sources of competitive advantage within it.