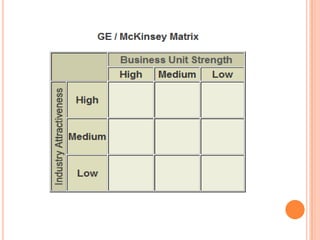

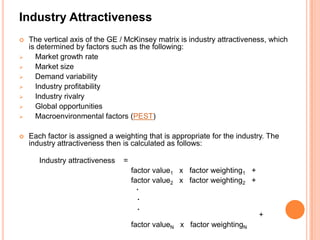

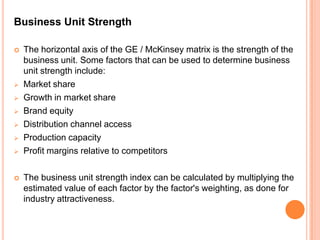

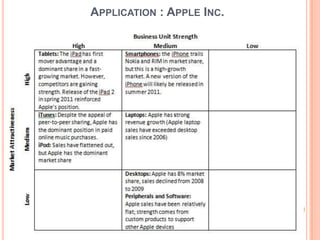

The document discusses strategic management tools including the GE/McKinsey matrix, which analyzes a company's business portfolio based on industry attractiveness and business unit strength. It explains how to calculate these factors and provides an example analysis of Apple Inc. The matrix is useful but also has limitations as it does not account for relationships between units or core competencies.