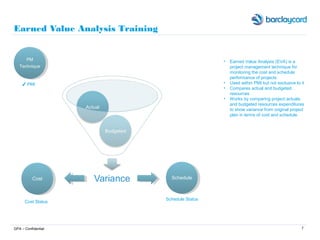

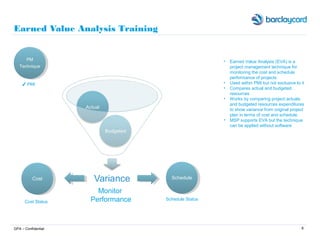

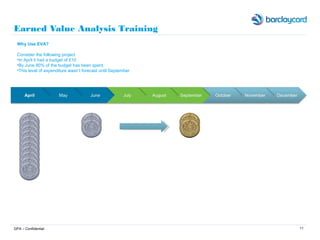

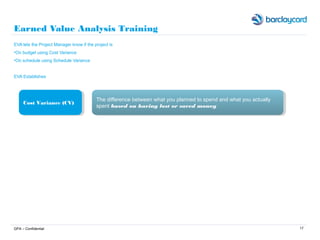

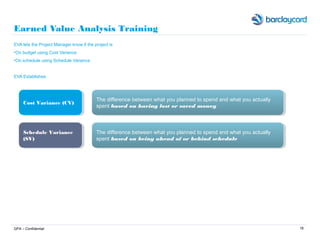

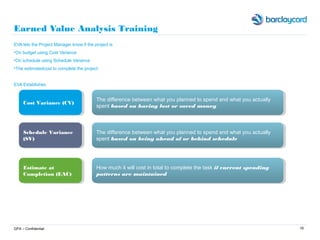

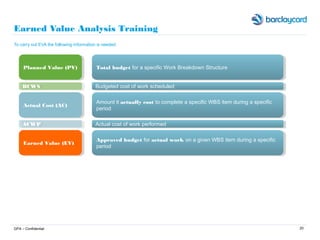

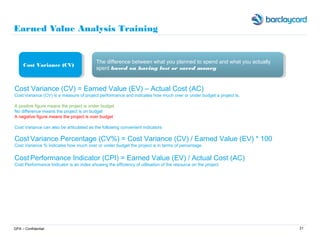

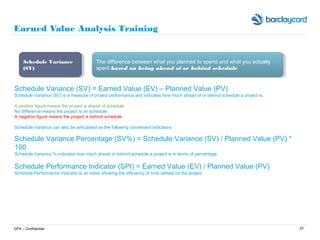

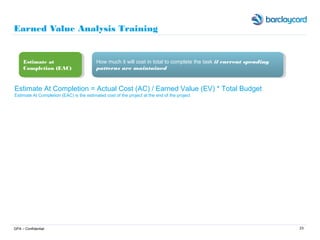

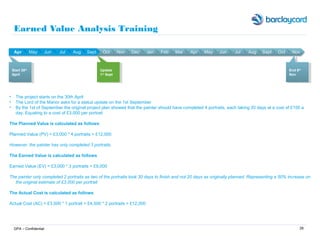

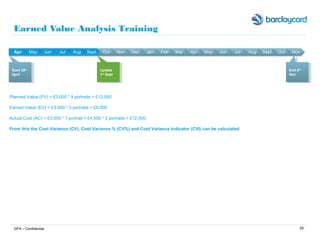

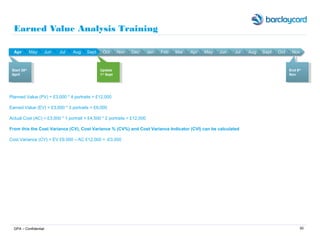

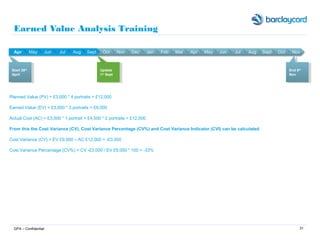

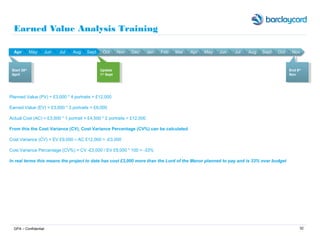

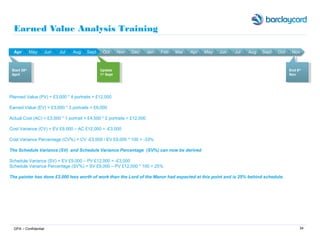

The document provides an overview of earned value analysis (EVA) training. It defines EVA as a project management technique for monitoring cost and schedule performance by comparing actual and budgeted resources. The training will cover what EVA is, why it is used, how EVA metrics like cost variance, schedule variance and estimate at completion are calculated, and examples of how EVA is applied. Attendees will learn how EVA can identify if a project is over budget or ahead of schedule so corrective actions can be taken.