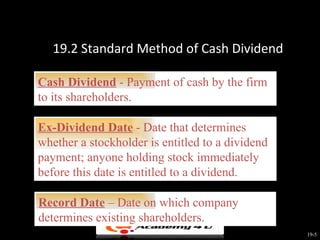

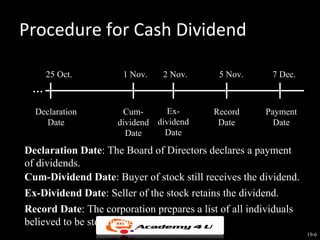

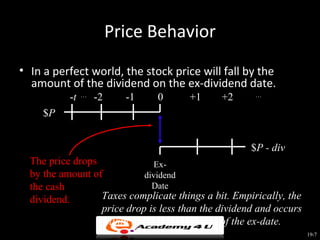

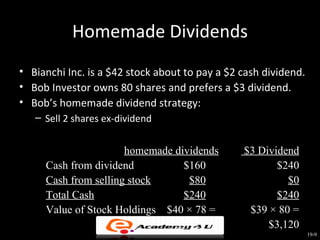

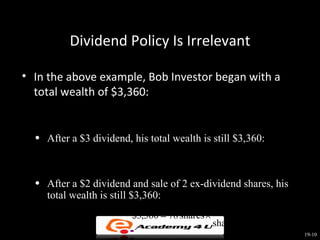

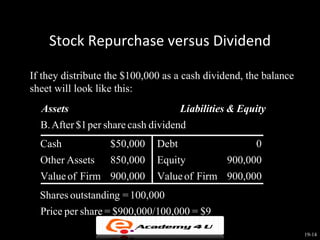

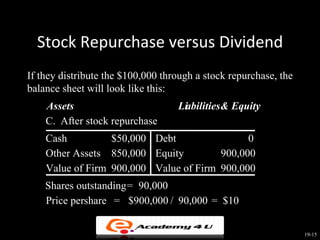

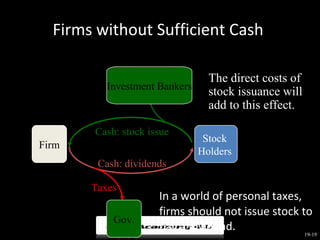

The document discusses different types of payouts companies can use to distribute cash to shareholders, including regular cash dividends, stock dividends, dividends in kind, and stock buybacks. It also covers the standard procedure for paying cash dividends, including declaration date, ex-dividend date, record date, and payment date. Additionally, it discusses the theory that dividend policy is irrelevant to the value of the firm since investors can create their own income streams through stock transactions.