This document discusses dividend policy and its objectives and factors. It defines dividend policy as a company's decision regarding distributing residual earnings to shareholders. The primary objective is maximizing shareholder wealth. While dividends increase share prices, they also reduce retained earnings available for new projects.

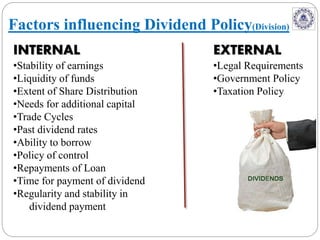

The objectives of dividend policy include maximizing shareholder wealth, ensuring sufficient retained earnings to finance future prospects, and maintaining a stable dividend rate. Factors that affect dividend policy include legal requirements, the company's liquidity, expected returns on reinvestment, earnings stability, shareholders' tax situations, and access to capital markets. Both internal factors like earnings stability and external factors like taxation policy influence a company's dividend policy.