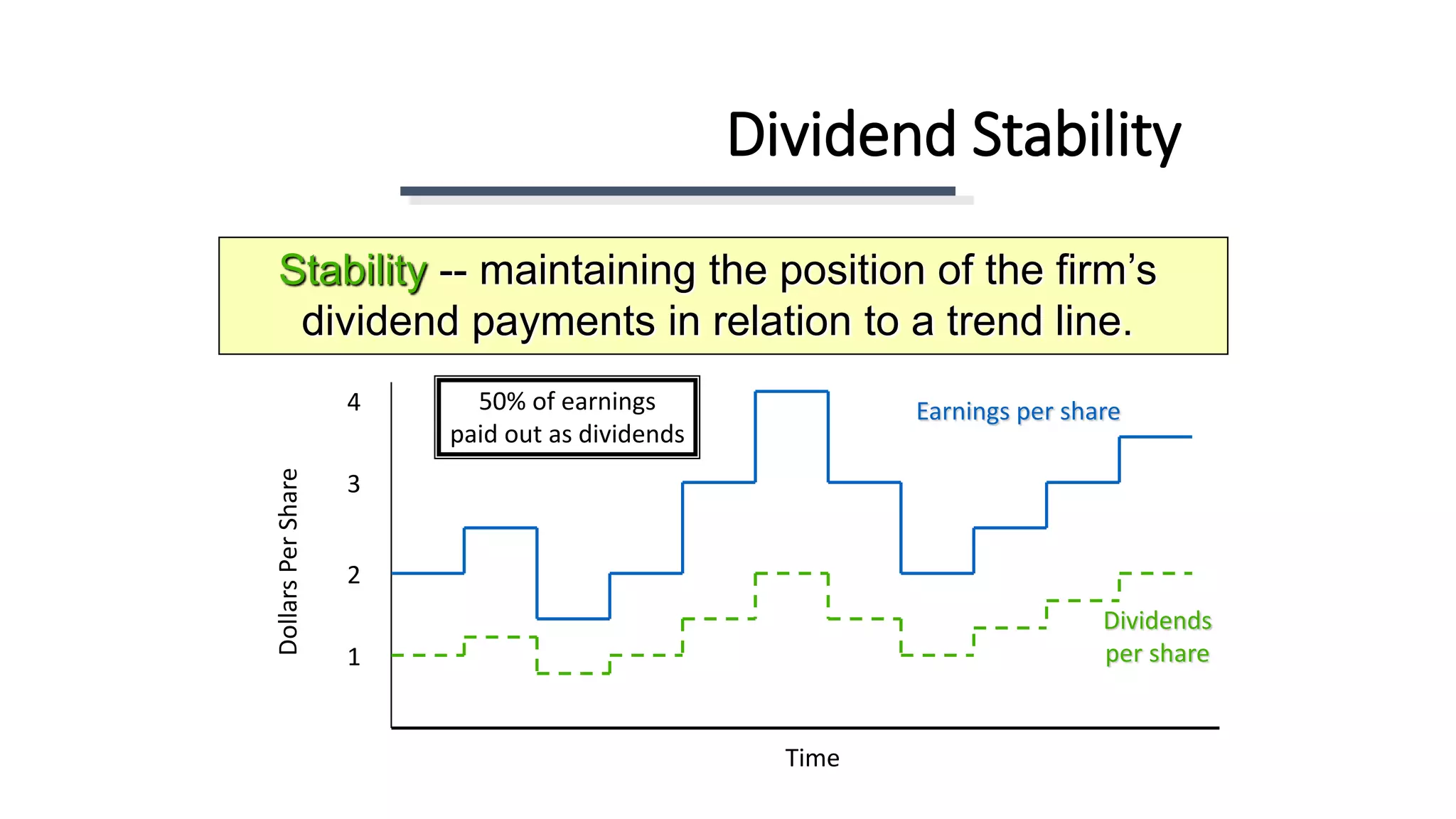

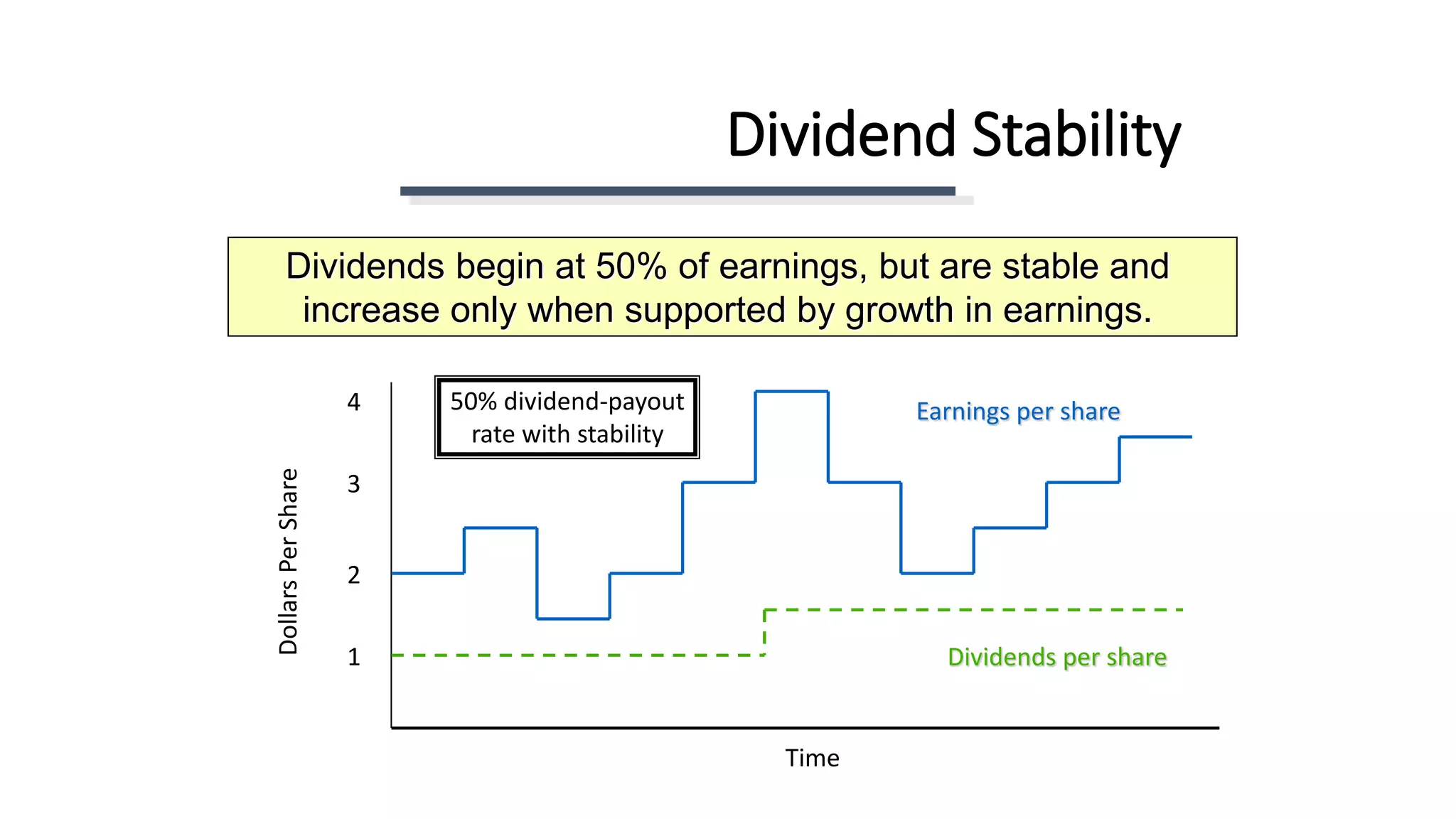

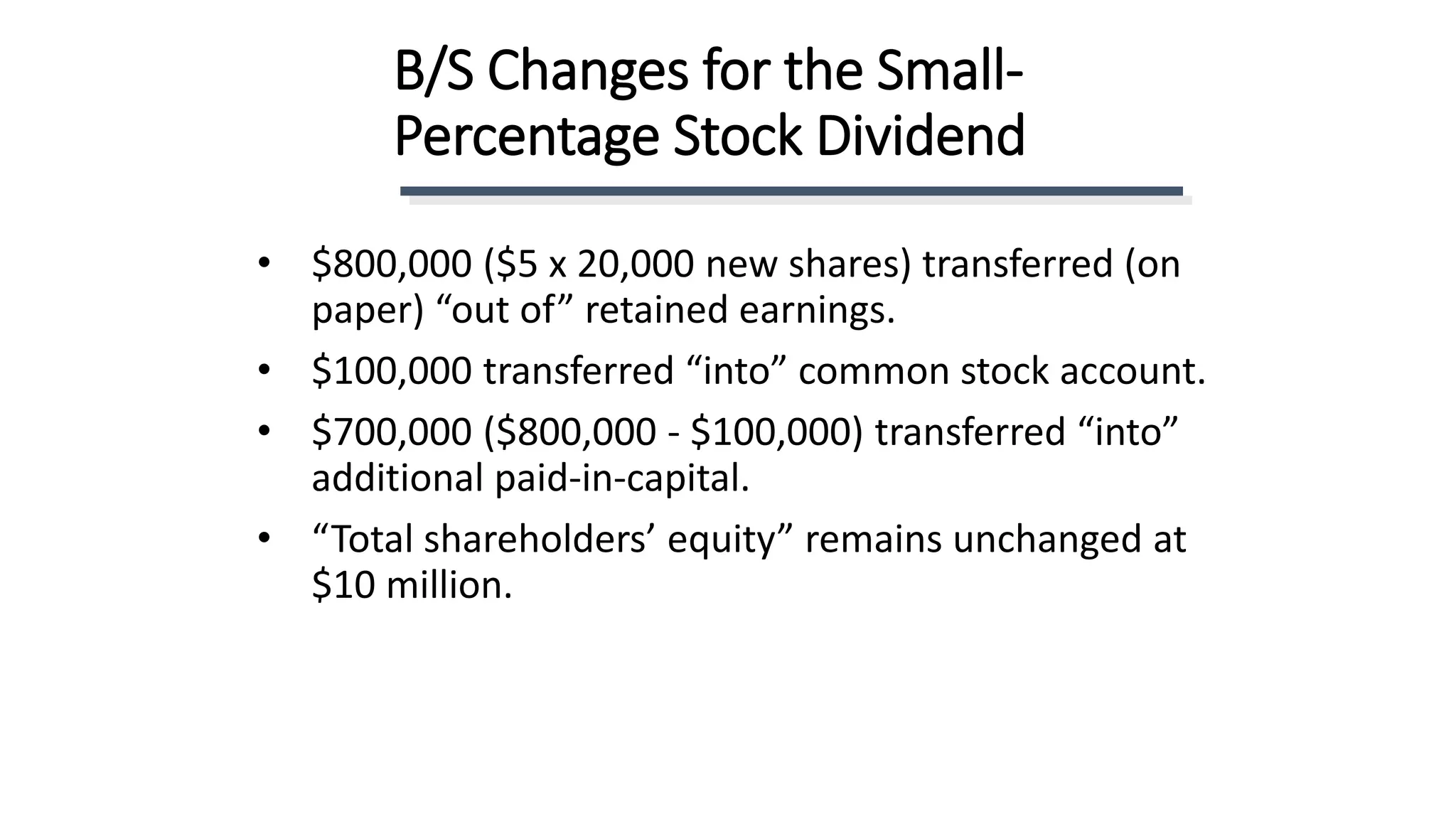

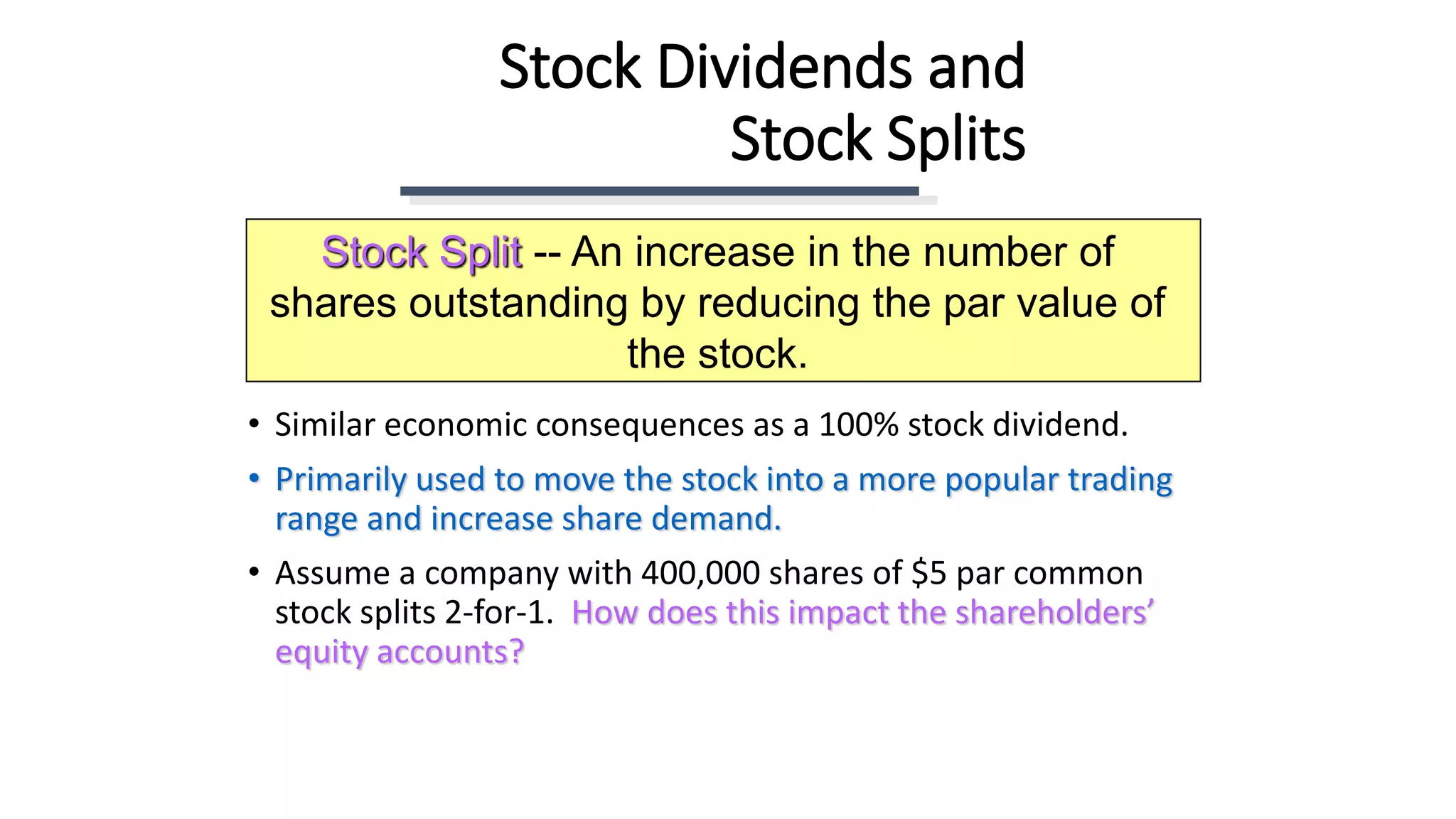

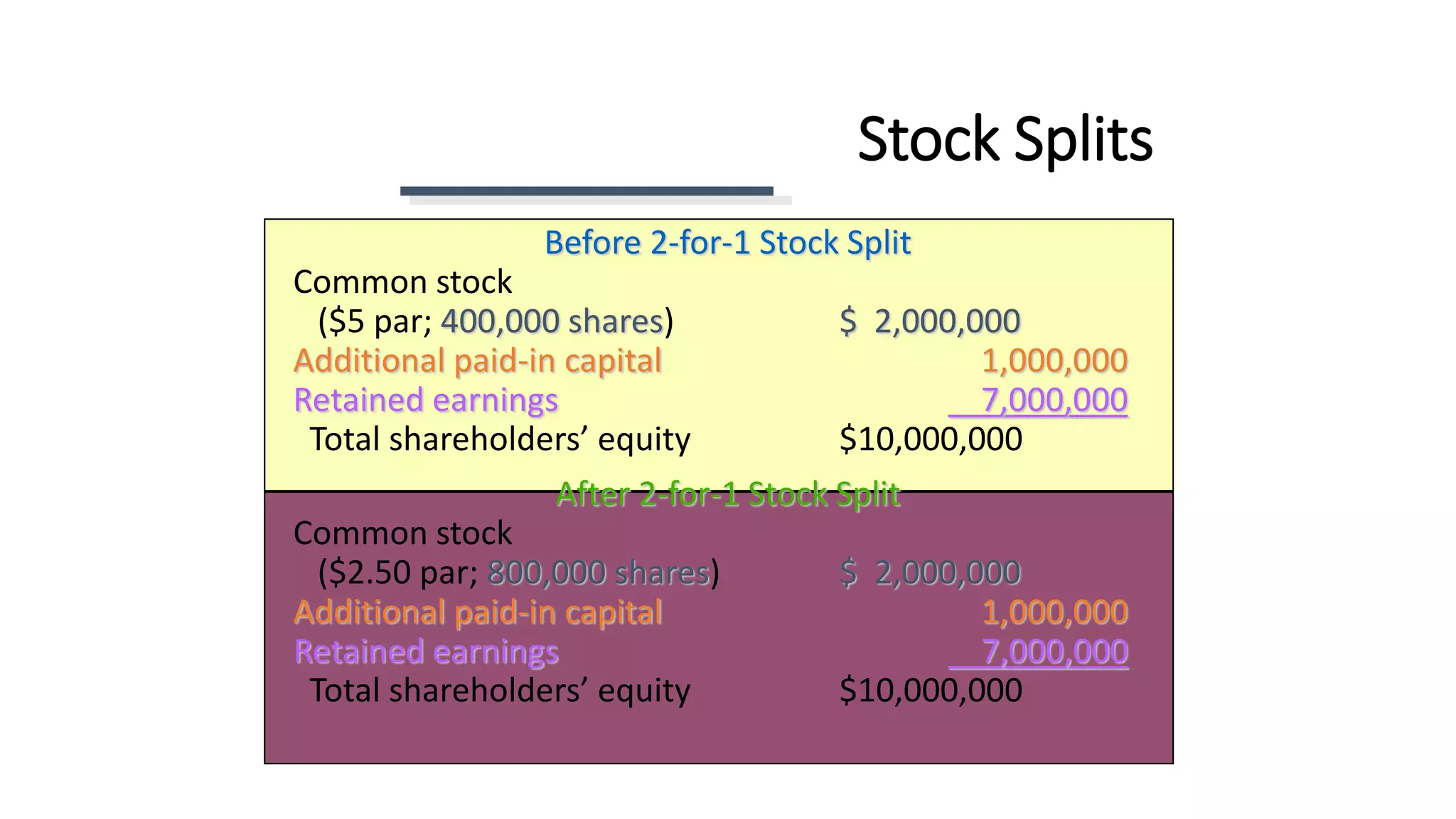

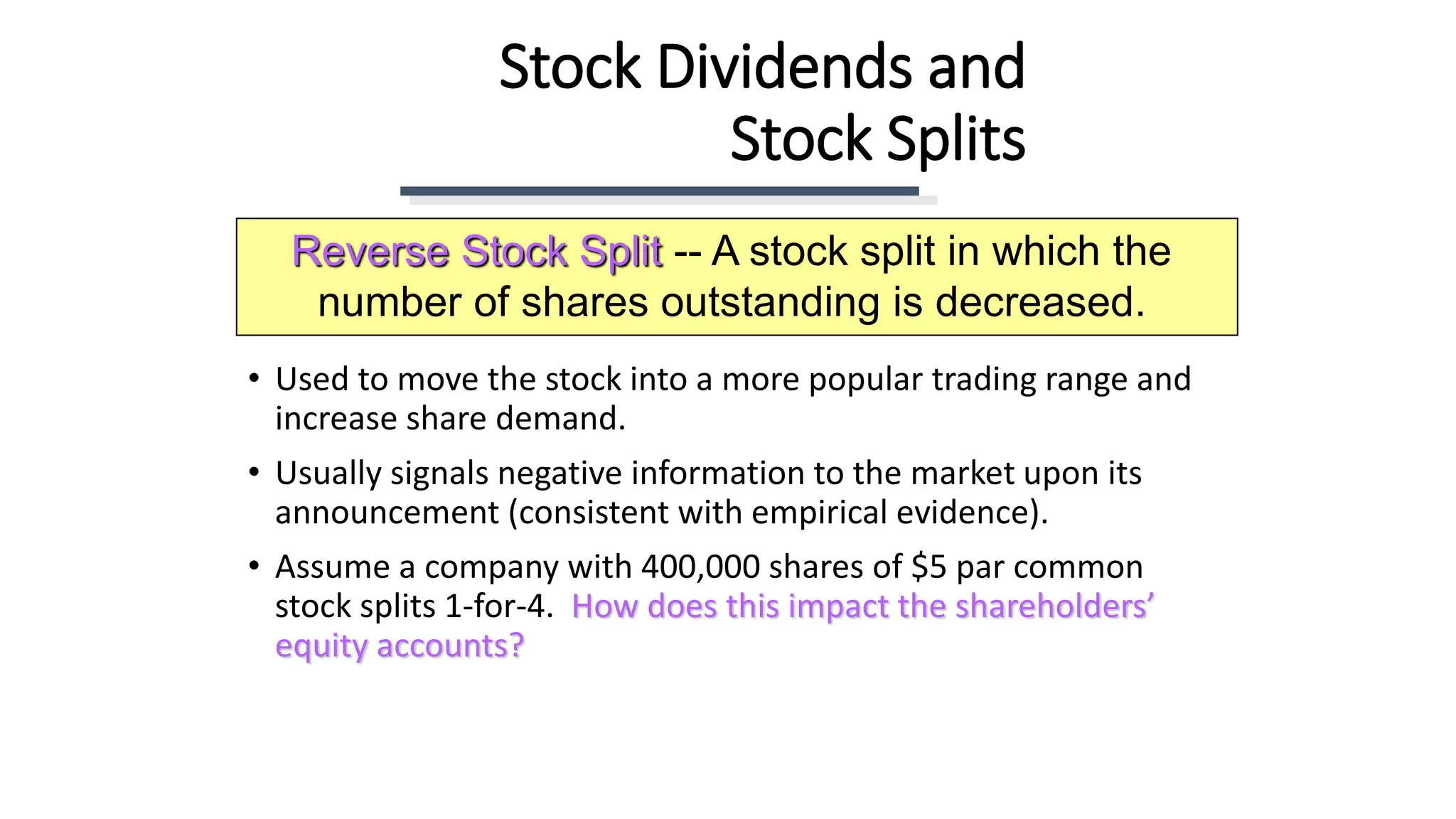

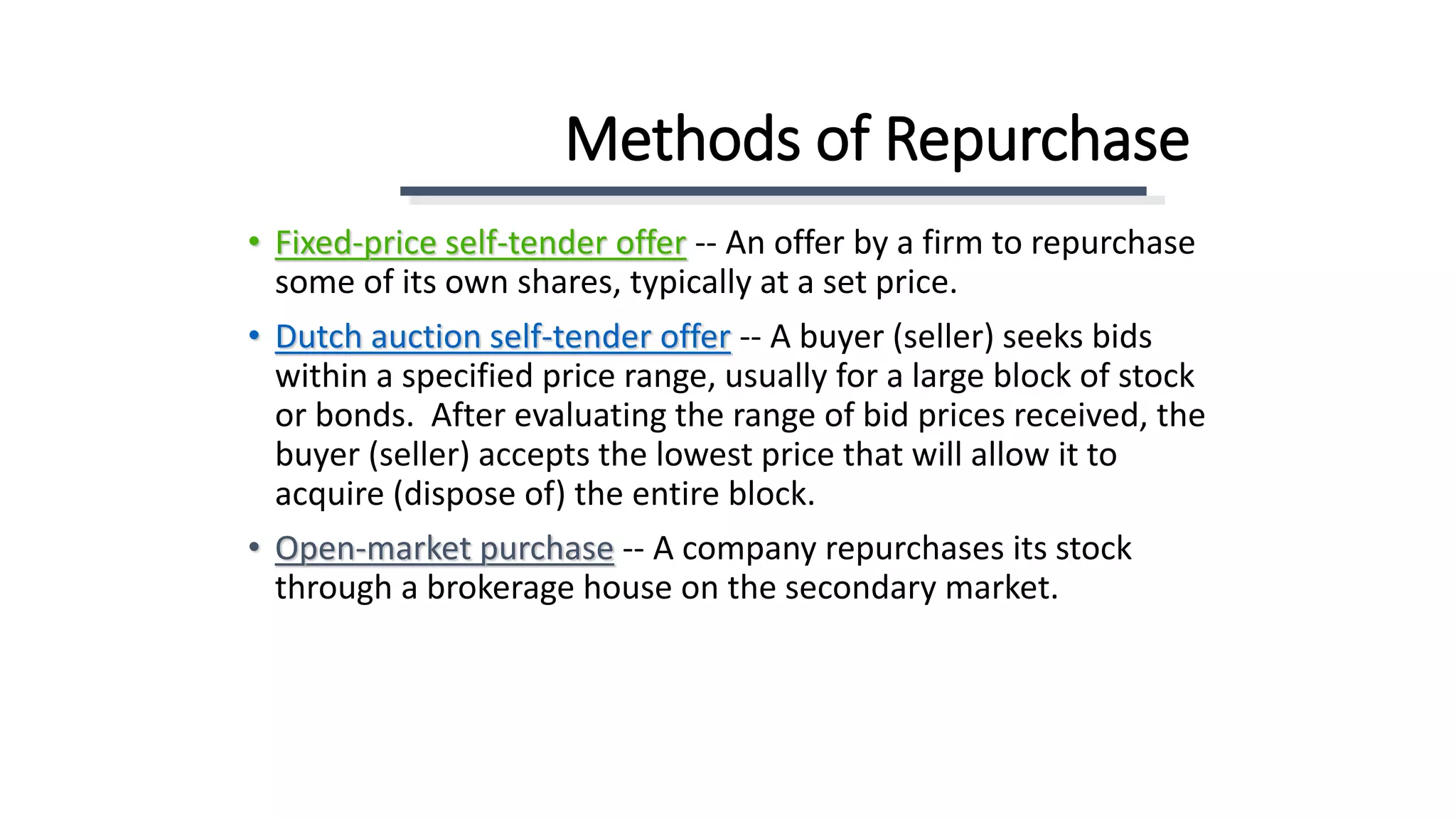

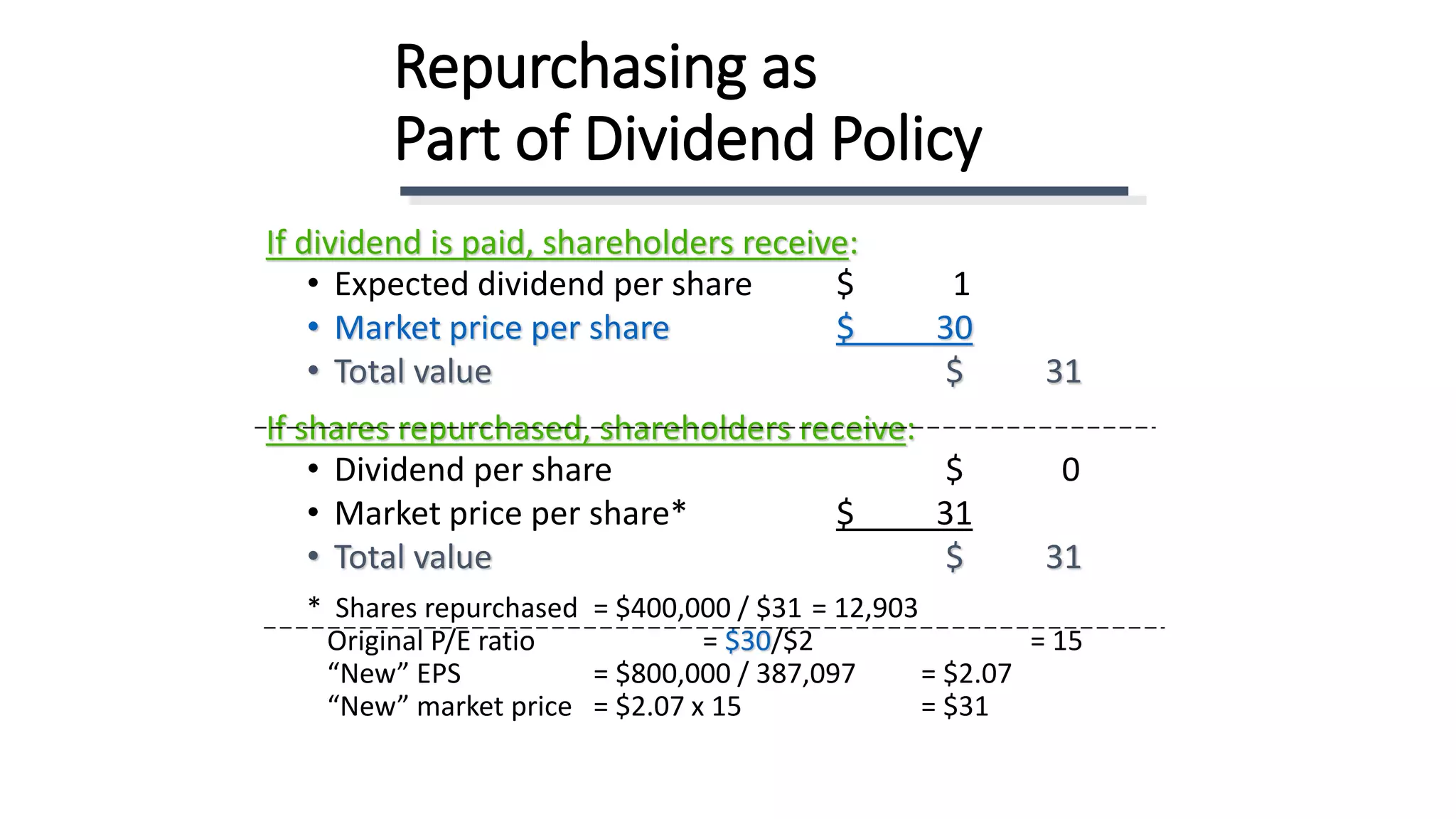

This document discusses dividend policies, including passive versus active strategies, factors influencing such policies, and the implications of cash dividends for shareholder wealth. It emphasizes the irrelevance of dividends under certain theories, examining issues like capital gains taxation, dividend stability, and corporate financial signaling. Additionally, it covers stock repurchase strategies, dividend reinvestment plans, and the associated administrative procedures involved in dividend payments.