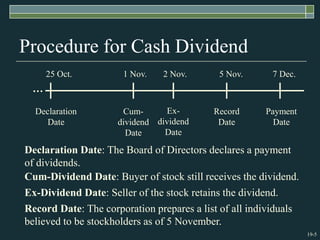

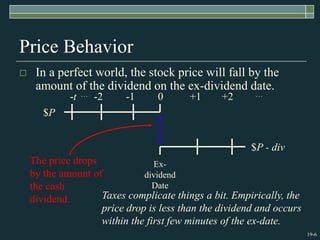

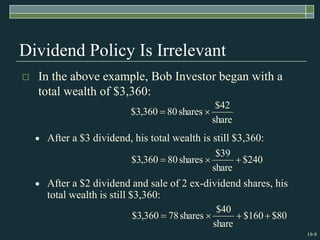

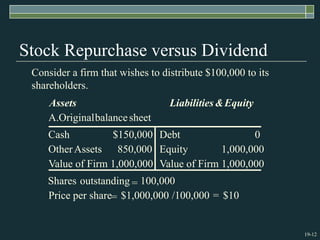

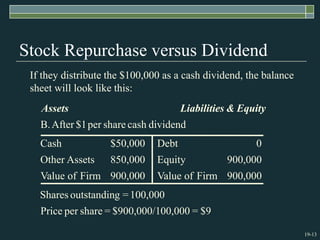

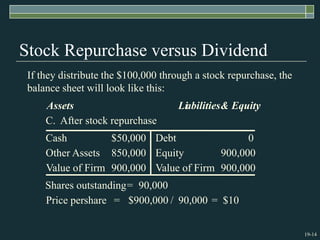

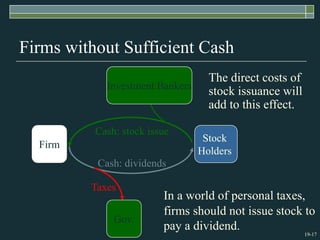

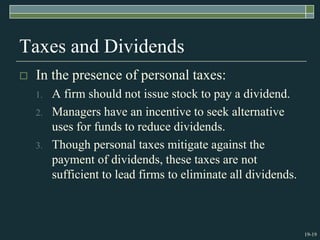

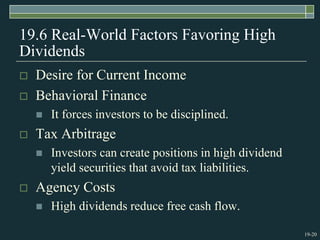

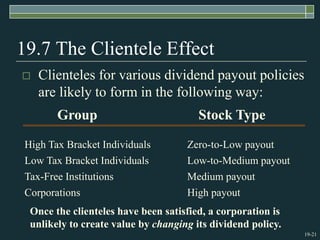

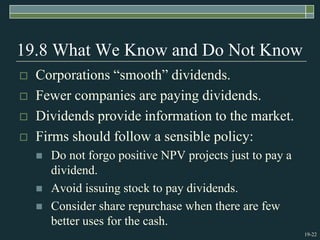

This chapter discusses different types of payouts such as cash dividends, stock dividends, and share repurchases. It explains how dividend policy is irrelevant if investors can create their own income streams, but real-world factors like taxes make repurchases preferable to dividends. The chapter also covers the clientele effect where different types of investors prefer certain payout policies, and how stock dividends and splits differ from cash dividends in increasing the number of outstanding shares.