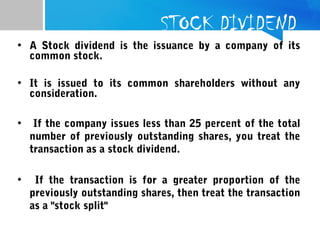

Dividends are a portion of a company's earnings distributed to shareholders, decided by the board of directors, and can be classified into several types: cash, stock, property, scrip, and liquidating dividends. Cash dividends are the most common, while stock dividends involve issuing more shares; property dividends involve distributing physical assets. The board determines the distribution timing, and key dates include declaration, record, and payment dates.