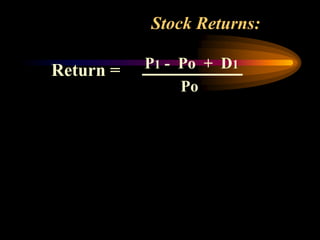

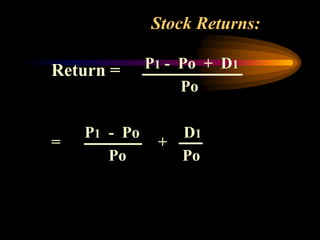

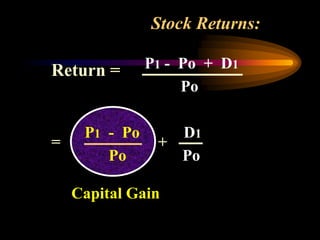

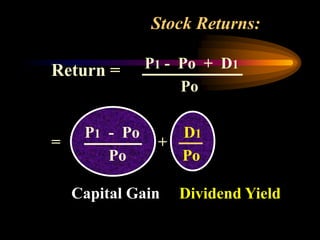

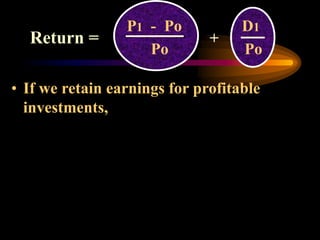

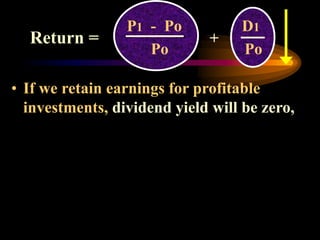

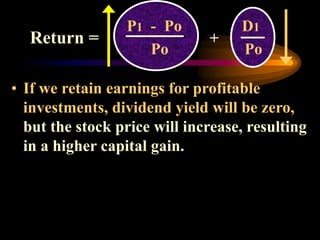

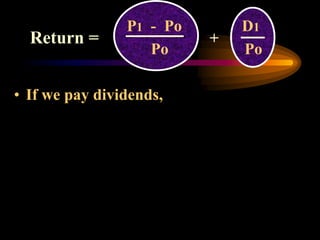

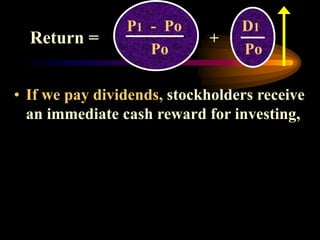

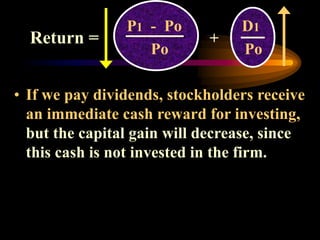

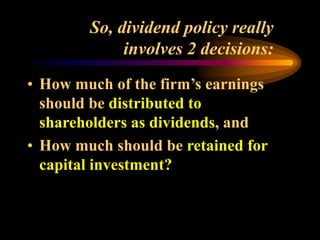

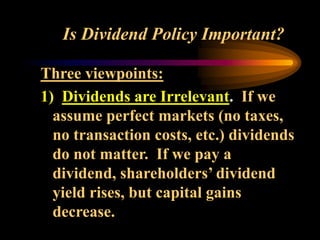

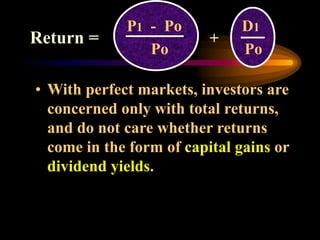

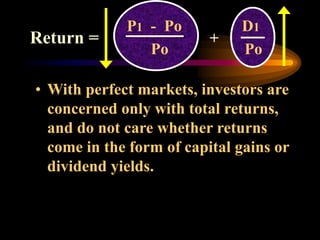

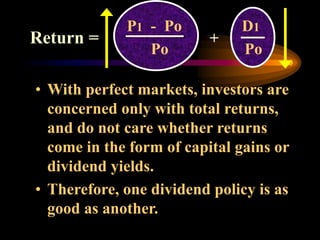

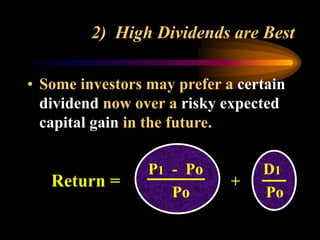

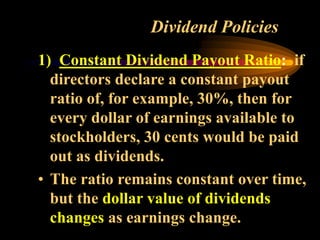

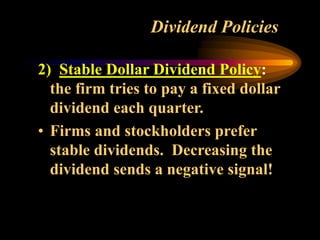

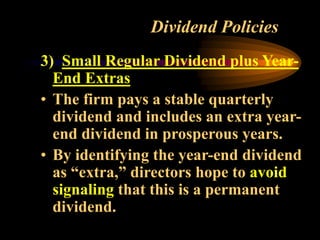

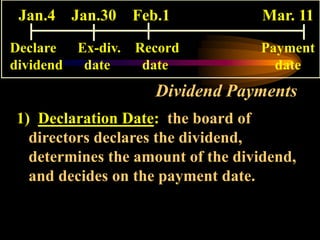

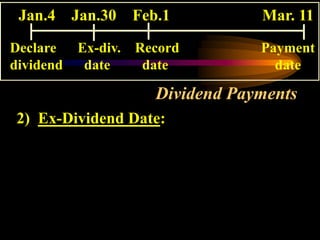

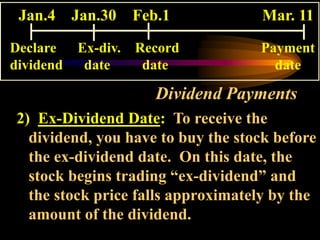

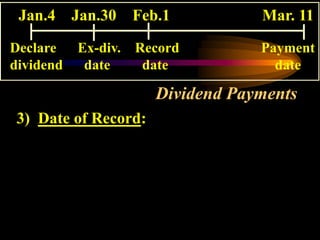

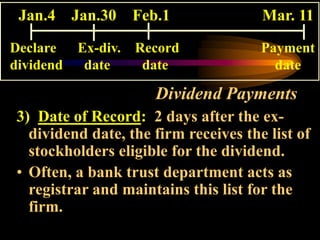

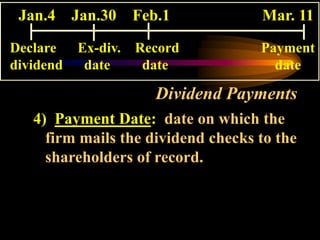

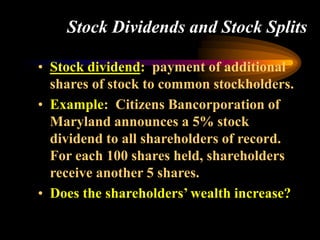

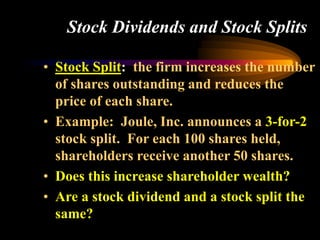

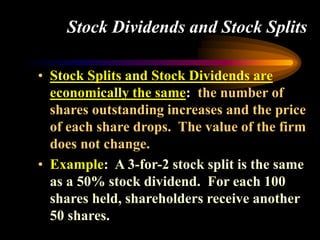

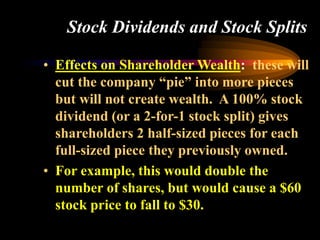

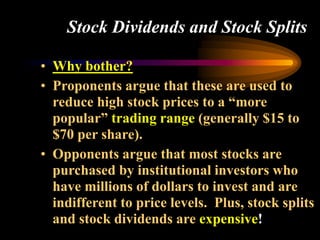

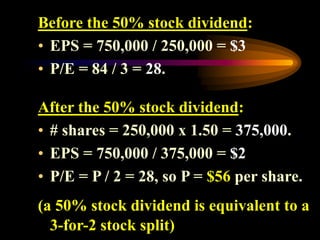

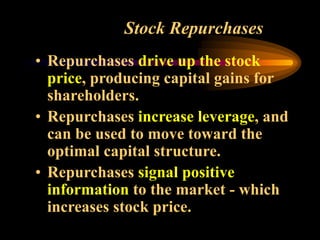

The document discusses stock returns and dividend policy. It explains that stock returns have two components: capital gains and dividend yield. It then discusses the dilemma firms face in deciding whether to retain earnings to finance investments or pay them out as dividends. The document considers different viewpoints on whether dividend policy is important and explores factors like taxes, signaling effects, and catering to different investor preferences. It also outlines various dividend policies and procedures firms use.