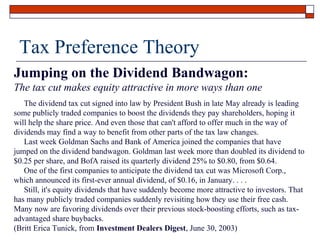

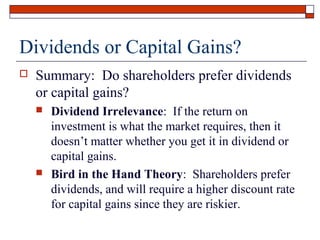

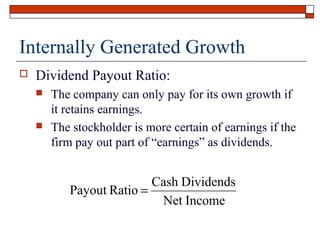

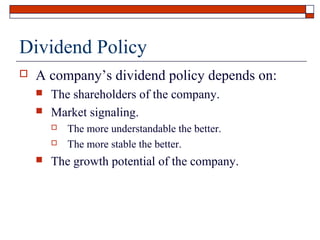

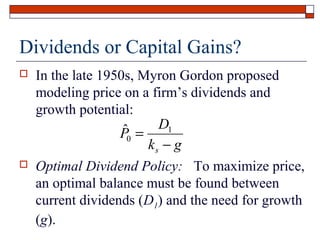

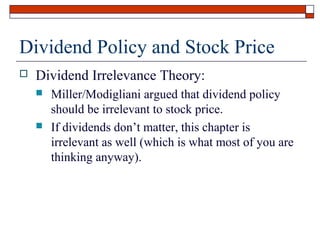

This document discusses various theories and considerations around dividend policy. It covers the dividend irrelevance theory proposed by Miller and Modigliani, which argues that dividend policy does not impact share price if assumptions like no taxes or brokerage fees hold. However, their assumptions are unrealistic. The document also discusses the bird-in-hand theory, tax preference theory, signaling theory, clientele effect hypothesis, and sustainable growth rate as additional factors in determining optimal dividend policy.

![Dividend Irrelevance Theory

1

Vt =

Dt + Vt +1 − mt +1 Pt +1

1 + rt

where rt = Discount rate

Dt = Total Dividends Paid

Vt +1 = Firm Value @ t +1 = nt Pt +1

mt +1 Pt +1 = Amount raised in equity

[

[

= I t − X t − Dt

]

]

I t = Capital Investments

X t = Income @ t](https://image.slidesharecdn.com/dividendpolicy-131211220737-phpapp02/85/Dividend-policy-6-320.jpg)

![Dividend Irrelevance Theory

[

1

Vt =

Dt + Vt +1 − I t + ( X t − Dt )

1 + rt

1

=

Vt +1 − I t + X t

1 + rt

[

]

]

Dividends are not in the final equation!

Therefore, dividends are irrelevant to value!](https://image.slidesharecdn.com/dividendpolicy-131211220737-phpapp02/85/Dividend-policy-7-320.jpg)