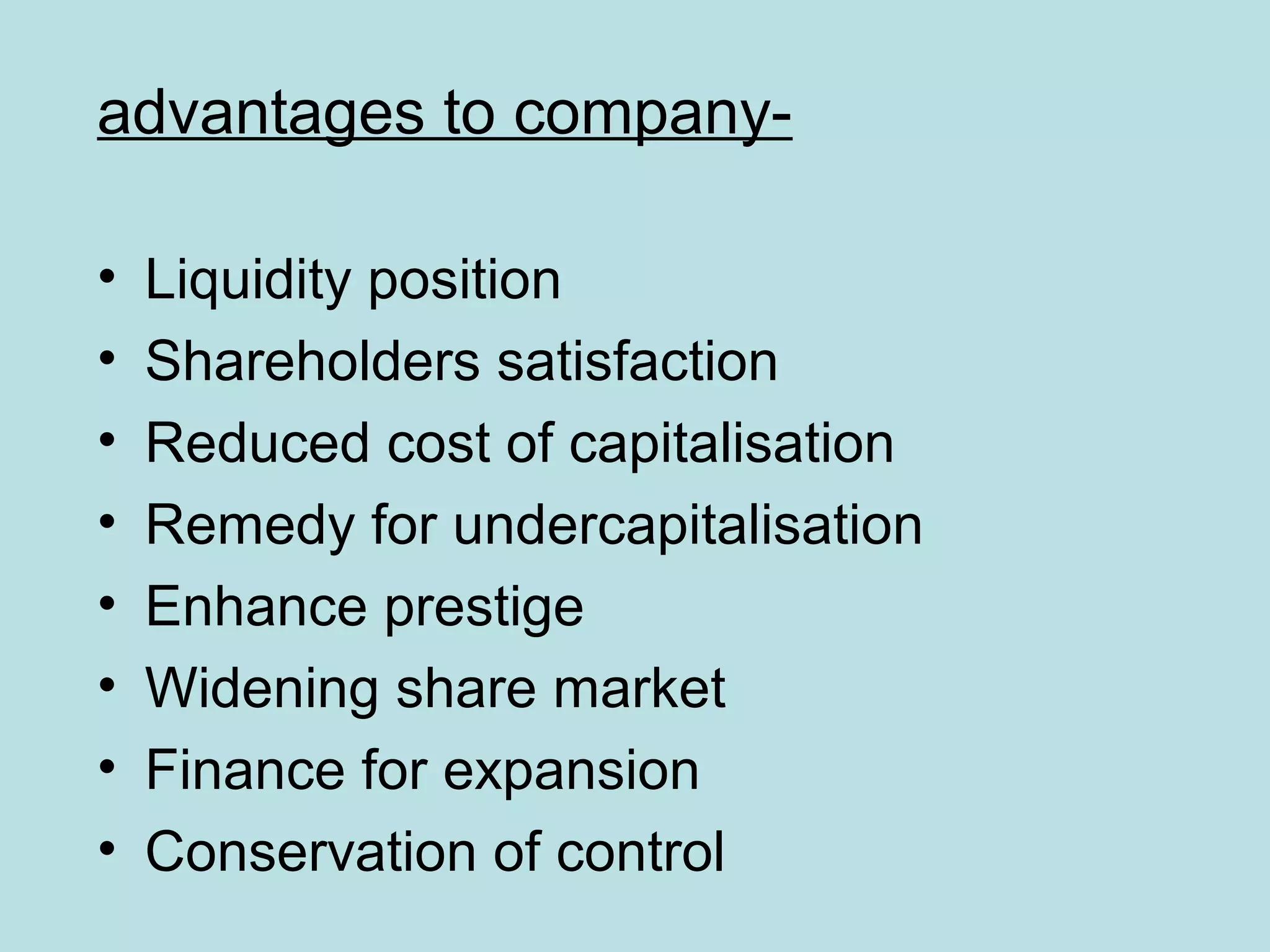

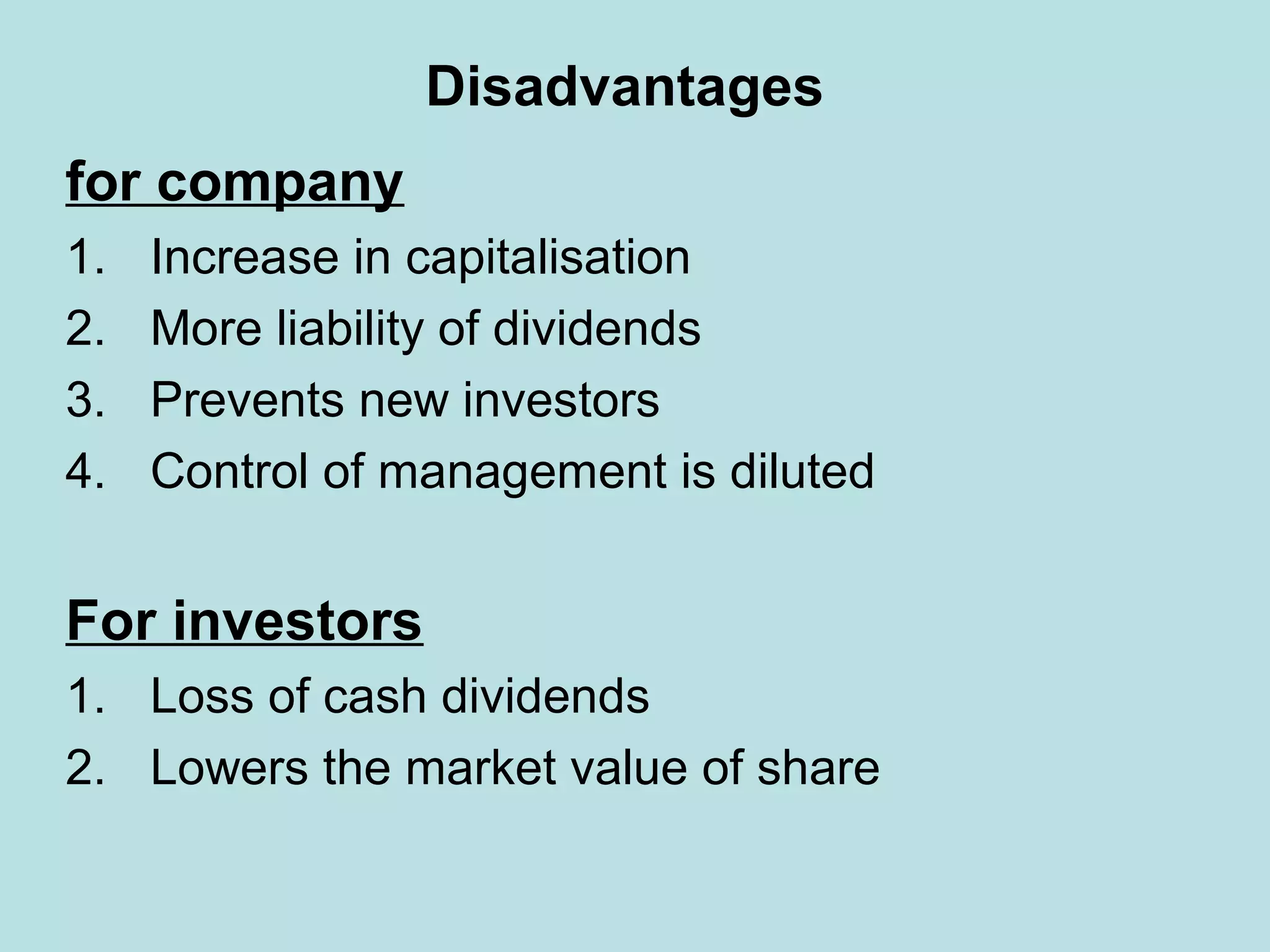

This document discusses dividend policy and the different types of dividends that can be distributed to shareholders. It outlines the key determinants of dividend policy, including transaction costs, taxation, liquidity, and growth opportunities. The document also describes different dividend policies like maintaining a constant dividend payout ratio or dividend rate. Finally, it examines stock dividends/bonus shares in more detail, noting the objectives, advantages, and disadvantages for both companies and investors.