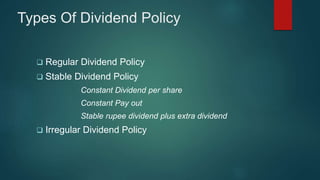

The document discusses the purpose of a dividend policy and its determinants and constraints. The purpose of a dividend policy is to determine the portion of net income paid out to shareholders in order to maximize shareholder wealth while providing sufficient financing for the company. A dividend policy must consider factors like dividend payout ratios, stable dividends, divisible profits, legal restrictions, owners' considerations, capital market conditions, industry type, ownership structure, and future financial needs. Constraints on a dividend policy include legal restrictions, financial condition, access to capital markets, and liquidity.