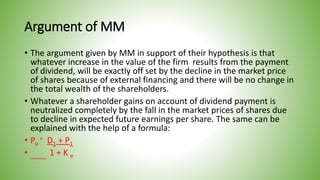

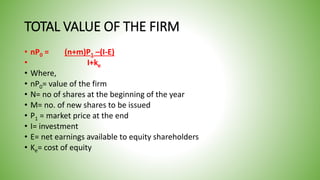

This document discusses dividend policy decisions and the MM approach. It begins by defining dividends and discussing sources and types of dividends. It then discusses what a dividend policy is and the key determinants of dividend policy such as legal restrictions, earnings trends, and shareholder preferences. The document also summarizes the irrelevance concept of dividends proposed by Modigliani and Miller, which states that dividend policy does not impact firm value under certain assumptions. It provides the formulas used in the MM approach to model how dividend payments do not affect share prices.