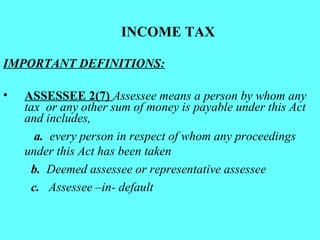

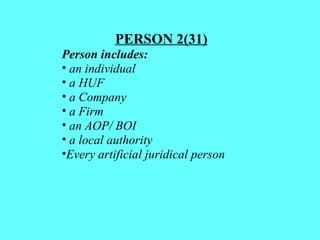

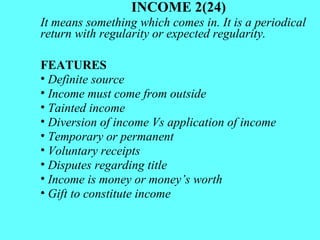

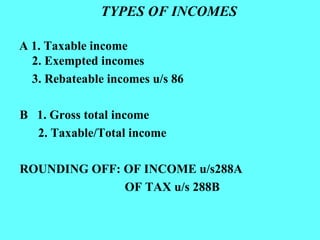

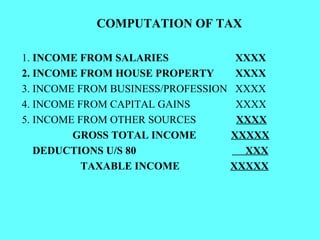

The document defines key terms related to income tax in India such as assessee, person, assessment year, previous year, types of income, and tax rates. It discusses how taxable income is calculated based on income from different sources such as salary, house property, business, capital gains, and other sources. It also outlines the incidence of tax for residents and non-residents depending on where the income is earned and received.