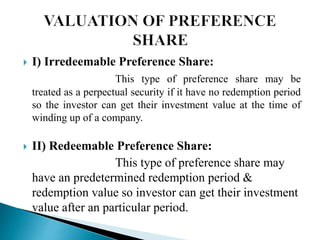

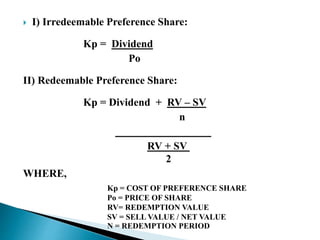

This document contains information about Dheeraj Agrawal's enrollment in a financial management course at Parul Institute of Management. It discusses various types of preference shares including cumulative vs non-cumulative, participating vs non-participating, convertible vs non-convertible, and redeemable vs non-redeemable shares. It outlines the key features and rights of each type of preference share from both a company and investor perspective. Formulas for calculating the cost of irredeemable and redeemable preference shares are also provided.