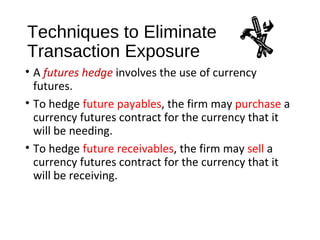

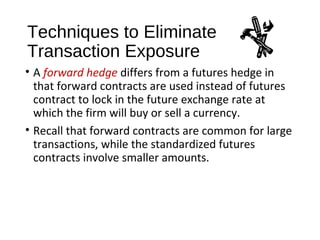

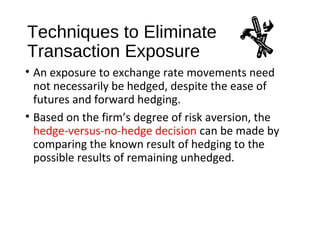

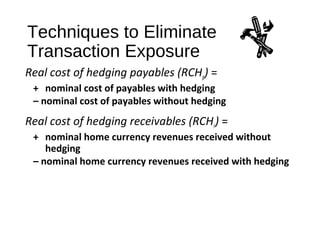

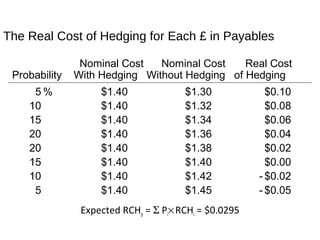

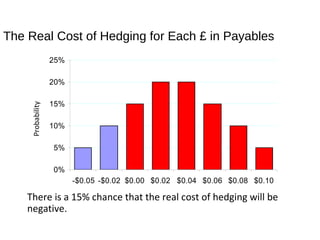

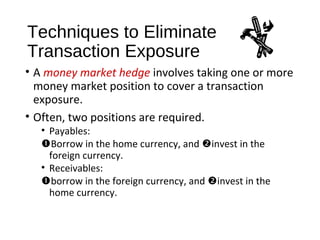

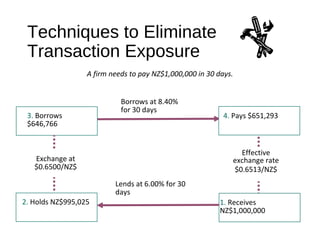

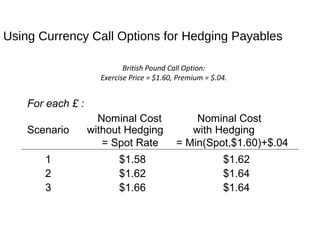

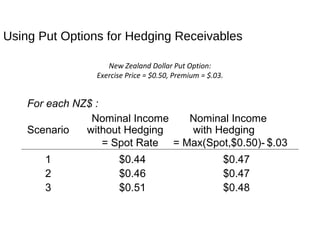

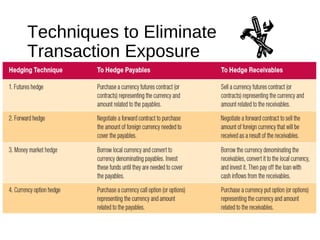

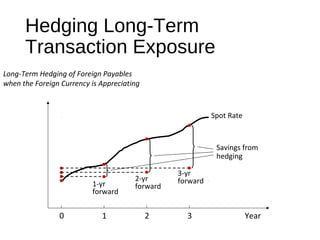

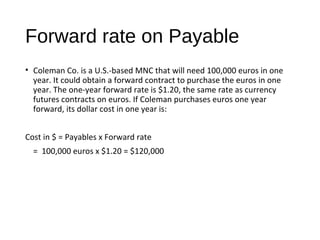

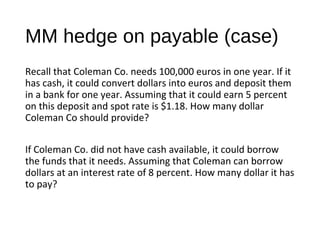

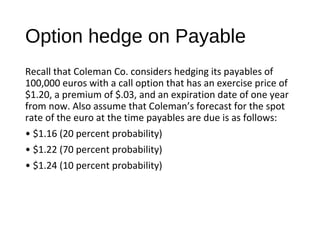

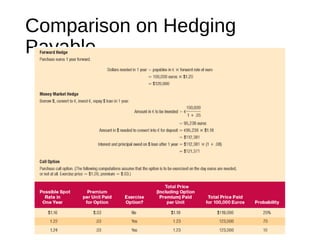

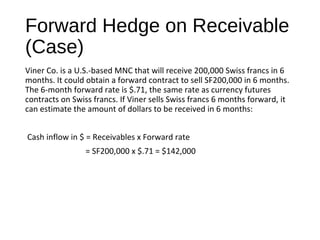

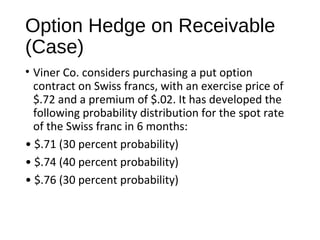

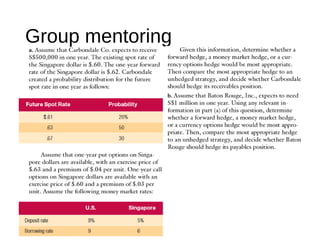

The document discusses managing transaction exposure for multinational corporations (MNCs), focusing on identifying transaction exposure and various hedging techniques such as futures, forwards, money market, and options. It compares the advantages and disadvantages of these methods, illustrates their real costs, and explores alternative strategies like leading, lagging, and cross-hedging. Additionally, the document highlights limitations of hedging and the impact of transaction exposure management on an MNC's value.

![Impact of Hedging Transaction Exposure

on an MNC’s Value

( ) ( )[ ]

( )∑

∑

+

×

=

n

t

t

m

j

tjtj

k1=

1

,,

1

ERECFE

=Value

E (CFj,t ) = expected cash flows in currency j to be

received by the U.S. parent at the end of period t

E (ERj,t ) = expected exchange rate at which

currency j can be converted to dollars at the end of

period t

Hedging Decisions on

Transaction Exposure](https://image.slidesharecdn.com/mki11-180312041626/85/Managing-Transaction-Exposure-48-320.jpg)