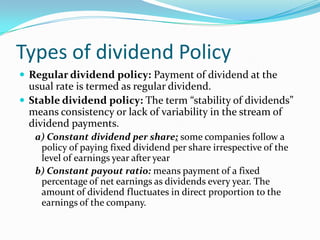

The document discusses dividend policy and its influencing factors. It defines dividends as profits distributed to shareholders. Key factors that influence dividend policy include legal restrictions, earnings trends, shareholder desires, industry nature, company age, future needs, economic conditions, taxation, inflation, control objectives, and institutional investor requirements. The types of dividend policies a company can have and forms of dividend payments are also outlined.