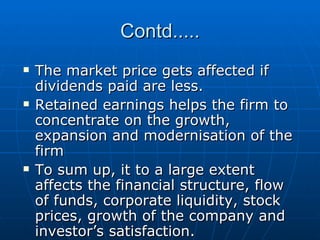

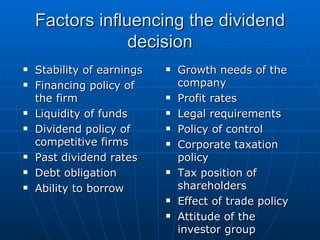

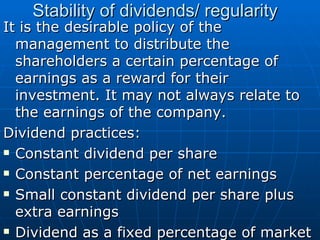

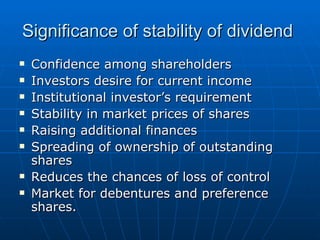

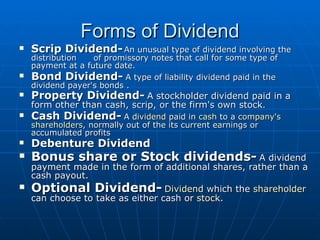

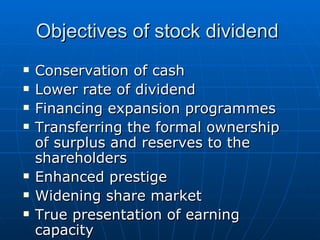

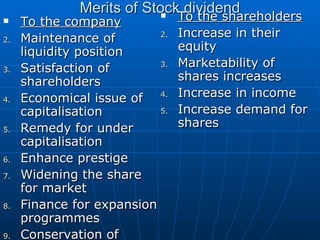

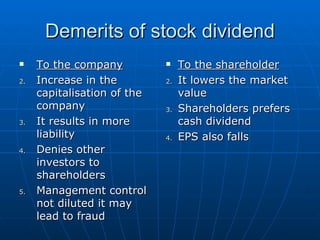

The document discusses dividend policy, including the meaning of dividends and different types of dividend policies companies can adopt. It also outlines several factors that influence a company's dividend decisions, such as earnings stability, financing needs, liquidity, and growth opportunities. Finally, it describes different forms of dividends including cash, stock, scrip and property dividends, and their potential merits and demerits.