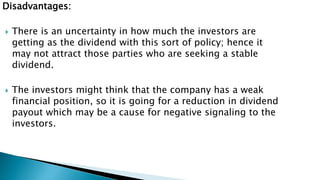

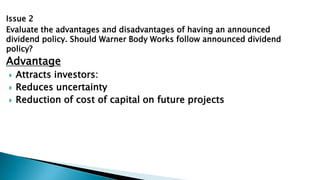

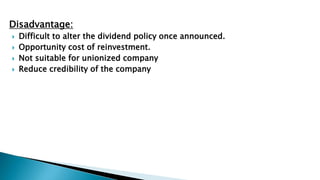

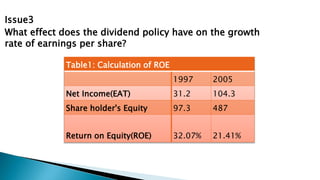

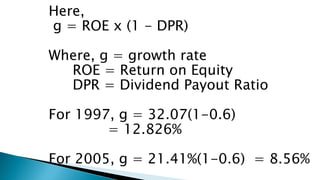

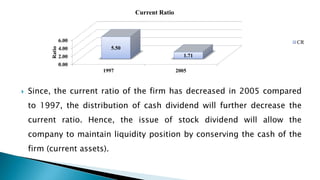

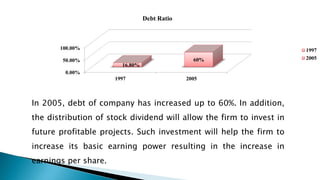

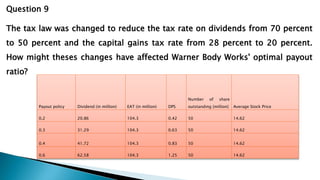

The document discusses the advantages and disadvantages of four different dividend policies for Warner Body Works: 1) Continuing the current 60% payout ratio, 2) Lowering the payout ratio below 60%, 3) Establishing a fixed dollar dividend that increases with earnings, and 4) Low payout supplemented by extra dividends. It also addresses how Warner Body Works' debt level and the changes in tax laws could impact its optimal dividend payout ratio. The assistant recommends a residual dividend policy for Warner Body Works given its growth opportunities, or otherwise a liberal policy, and issues cautions about debt and ignoring investor preferences when setting capital structure and budgeting decisions.