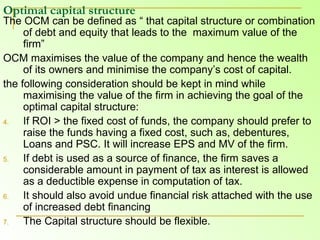

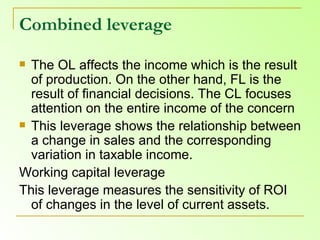

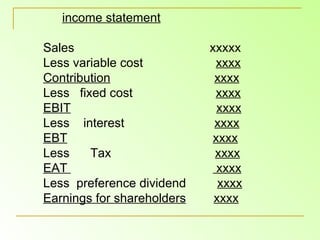

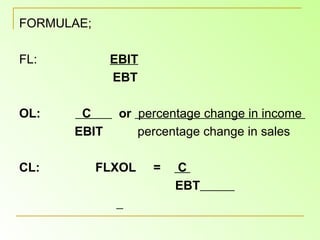

The document defines capital structure as the composition of a company's long-term financing, including loans, reserves, shares, and bonds. It discusses factors that influence a company's capital structure such as financial leverage, risk, growth, and cost of capital. It also discusses the concept of an optimal capital structure that maximizes firm value. The document then covers related topics like the point of indifference, types of leverage including financial and operating leverage, and how they impact a company's earnings.