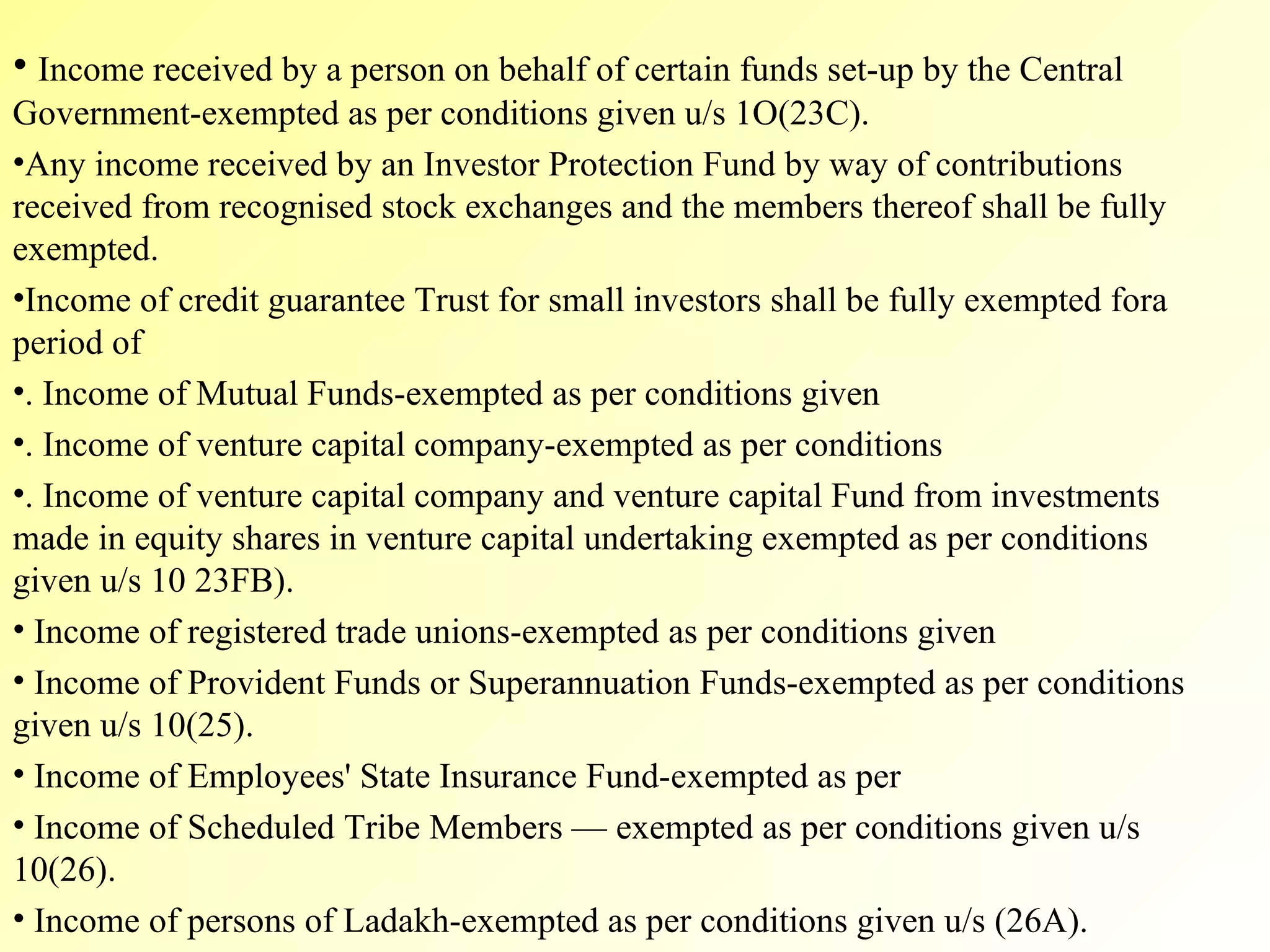

The document lists various types of incomes that are fully or partially exempted from tax under Section 10 of the Indian Income Tax Act. Some key exemptions include agricultural income, income from house property, income of members of armed forces, income of MPs/MLAs, income from certain investments, scholarships, pension funds, mutual funds, dividends, long term capital gains and more. The exemptions are subject to various conditions specified under the relevant sections of the Income Tax Act.

![. Educational Schoiarships-Fully exempted u/s 10(16). Allowances received by MP/MLAMLC fully Exempted u/s 10(17). Any award instituted or notified by State or Central Govt.-Fully exempted u/s 10(17 A). Any pension received by winners of Paramvir Chakra, Mahavir Chakra, or Vir Chakra, and family pension received by widows or children or nominated heirs of a deceased member of the armed forces (including para military forces) during operation shall be fully exempted u/s 10 (18) and [10(19)]. Income from one palace self occupied by former rulers shall be fully exempted u/s 10(19A). Income of a local authority-exempted as per conditions given u/s 10(20).35. Income of a scientific research association-exempted as per conditions given u/s 10(21).](https://image.slidesharecdn.com/exempted-incomes1-1227282755221339-9/75/Exempted-Incomes1-3-2048.jpg)

![Income of a corporation set up for promoting the interests of Scheduled castes, tribes and backward classes-exempted as per conditions ). Any income of a corporation established by a Central, Slate or provincial Act for the welfare and economic up liftrnent of ex-servicemen being the citizens of India shall be fully exempted. Income of a cooperative society set up for promoting the interests of scheduled castes, tribes and backward classes-exempted Amount received as subsidy from or through Tea Board-Fully exempt Amount received as subsidy from or through Rubber, Coffee or any other Board set up for growing 67 commercial crops-Fully exempted In case income of a minor child is clubbed with income of either of his parents u/s 64(IA), that parent can claim an exemption u/s 10(32) of Rs. 1.500 per child whose income is so clubbed. Income by way of dividend from Indian company [Section 10(34)].](https://image.slidesharecdn.com/exempted-incomes1-1227282755221339-9/75/Exempted-Incomes1-7-2048.jpg)

![Income from units of UTI and other Mutual Funds [Section 10(35) Income from sale of shares in certain cases [Section 10(36)1- Any income arising from the transfer of a long-term capital asset, being an eligible equity share in a company purchased on or after the 1 st day of March, 2003 and before the 1 st day of March 2004 and held for a period of twelve months or more. Long Term Capital Gain on transfer of securities covered under Transaction Tax [Section 10 (38)]](https://image.slidesharecdn.com/exempted-incomes1-1227282755221339-9/75/Exempted-Incomes1-8-2048.jpg)