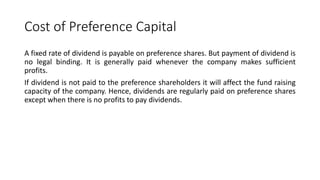

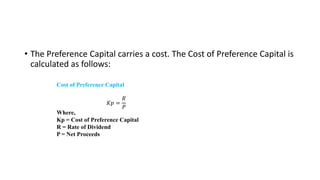

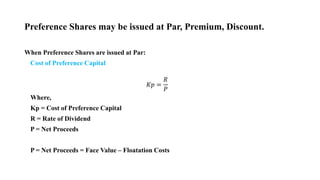

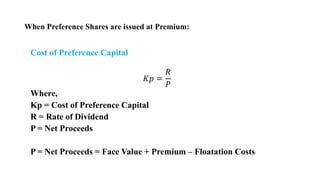

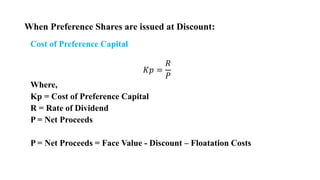

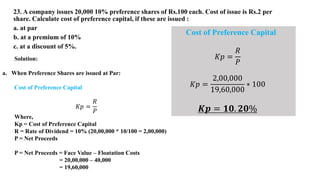

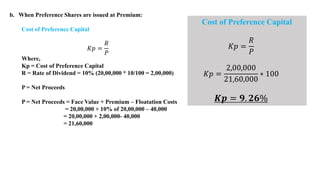

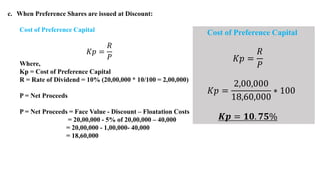

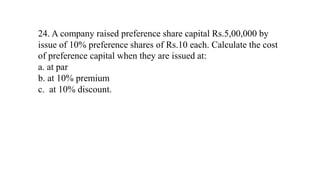

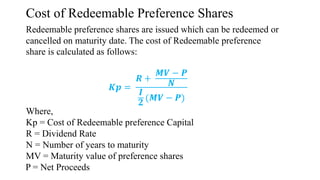

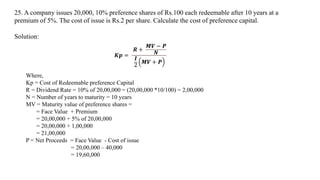

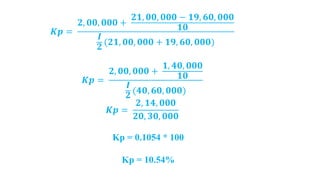

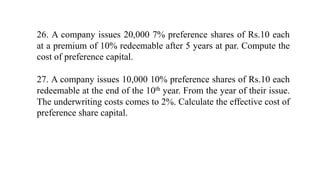

The document outlines the concept of preference capital and its cost, explaining how to calculate the cost based on different scenarios: at par, premium, and discount. It provides detailed examples of calculations for companies issuing preference shares, taking into account factors such as flotation costs and redemption value. Additionally, it discusses the implications of not paying dividends on preference shares and their effect on a company's fundraising capacity.