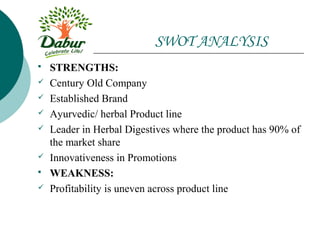

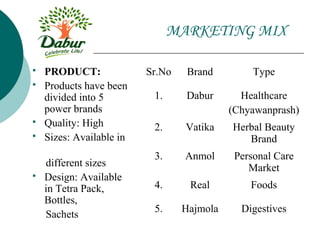

Dabur is a 100+ year old Indian FMCG company with a turnover of Rs.1899.57 crore. It has power brands like Dabur Amla, Chyawanprash, Real, Vatika, and Hajmola. To increase growth, Dabur restructured in 2004 into three SBUs and focused on five power brands. It changed its branding strategy from umbrella to key brands and did product line extensions. Dabur has strengths in its heritage and market leader positions. It aims to increase market share through new products, markets, and promotions utilizing celebrities and events.