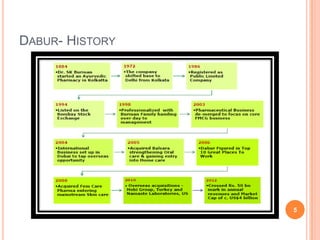

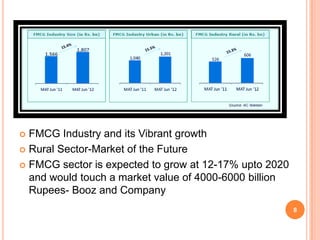

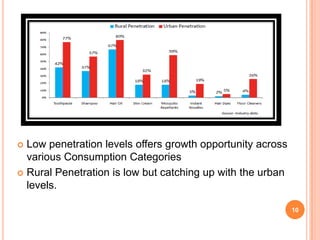

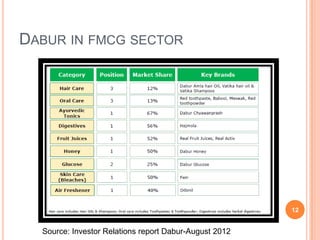

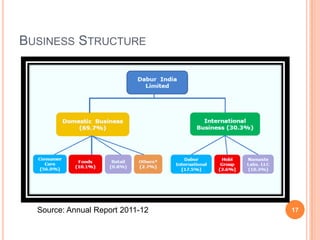

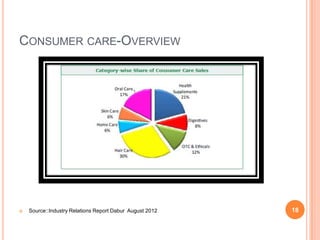

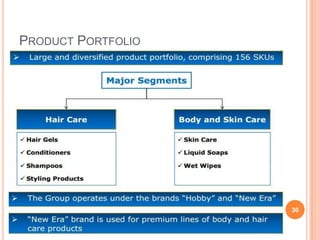

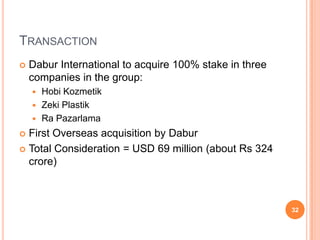

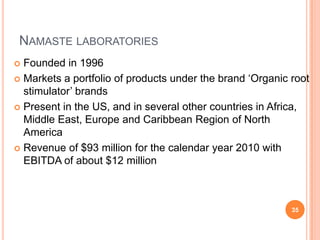

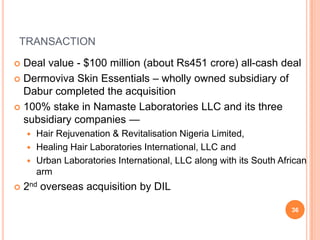

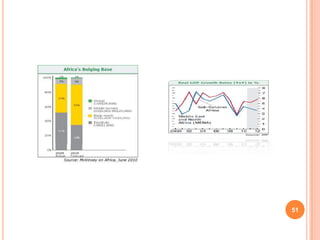

Dabur India Ltd is a 125-year-old FMCG company and India's third largest in this sector. It has a wide product portfolio spanning various categories like hair care, oral care, skin care, etc. sold through a network of 3.4 million retailers across India. Dabur has pursued international expansion through acquisitions of companies in markets like Middle East, US, and Turkey. It aims to leverage these acquisitions to grow in new international markets and categories. The company has a strong focus on Ayurveda and herbal products where it sees further growth opportunities.