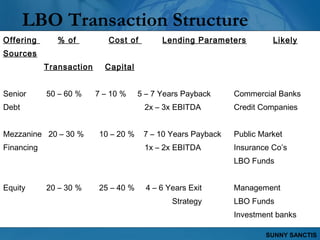

A leveraged buyout (LBO) involves using borrowed money to acquire a company, with the acquired company's assets used as collateral. Private equity firms will typically finance 70% or more of the purchase price through borrowing, with the remaining 30% as equity. The debt holders receive a fixed rate of return, while the equity holders seek very high returns. If successful, the equity holders can realize their returns within 3-5 years by selling the company or taking it public.