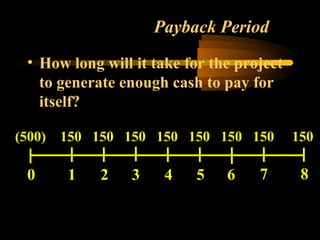

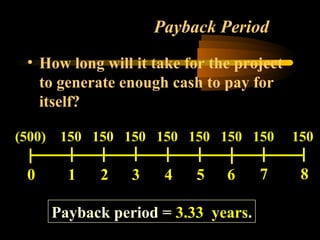

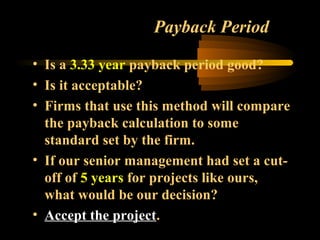

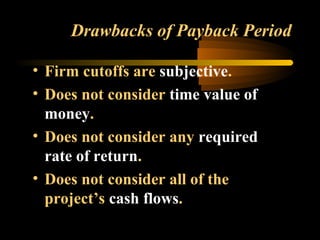

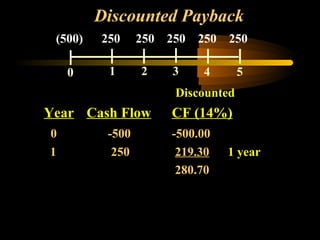

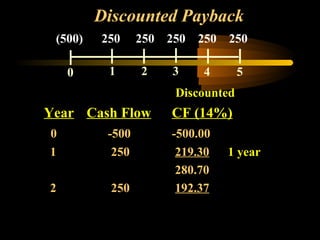

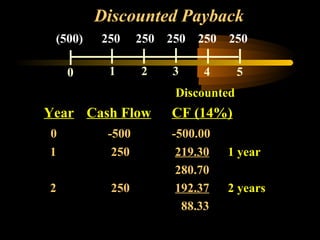

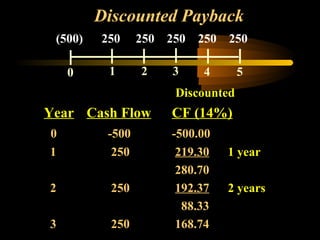

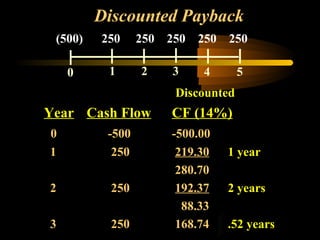

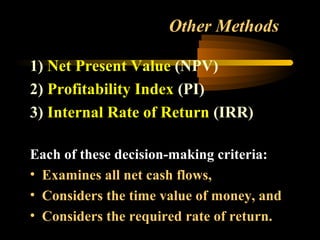

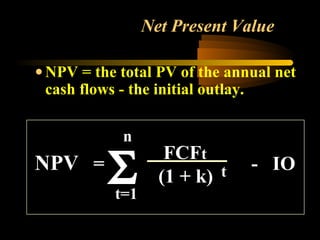

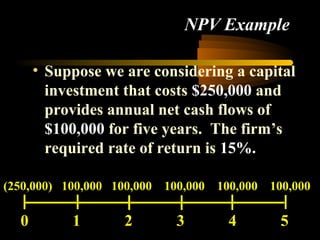

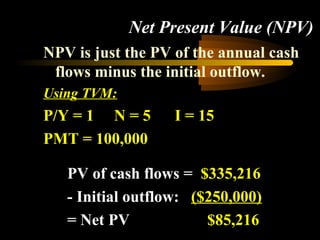

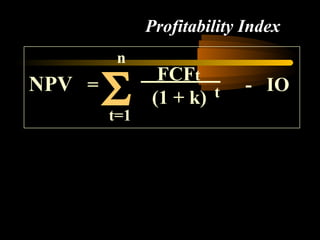

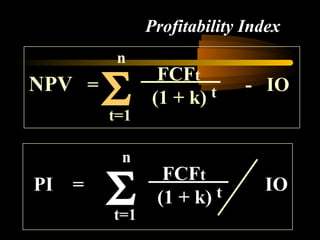

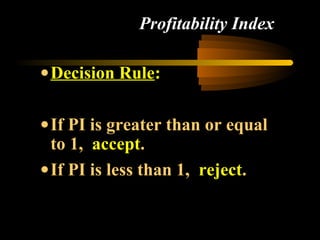

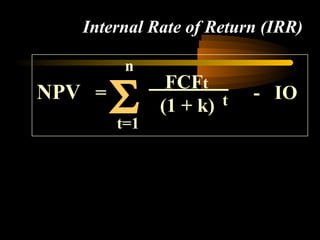

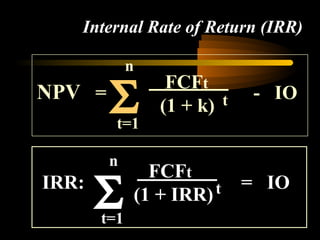

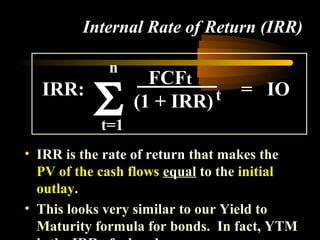

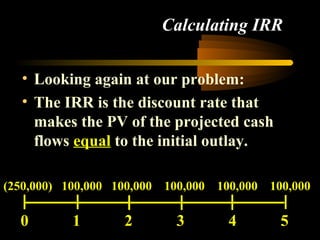

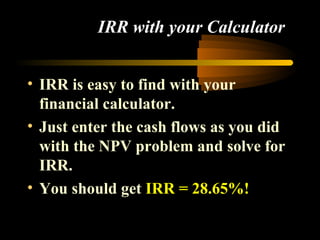

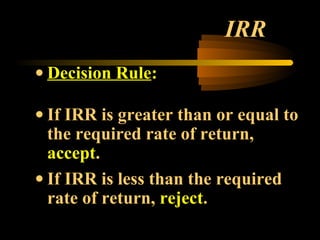

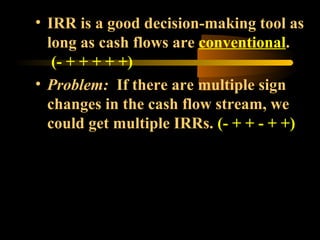

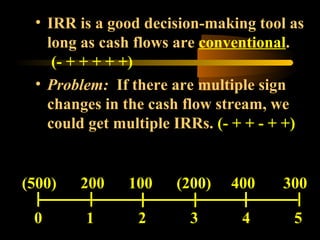

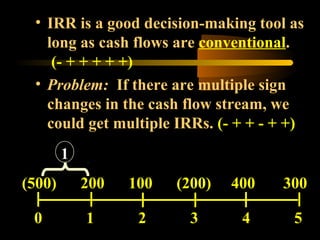

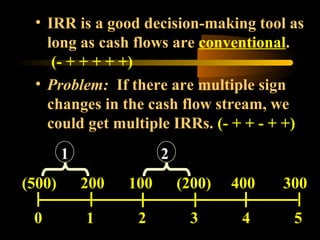

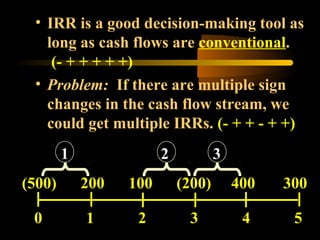

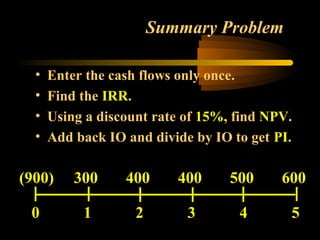

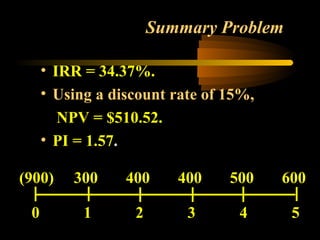

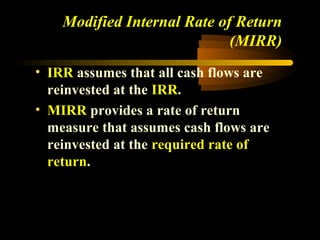

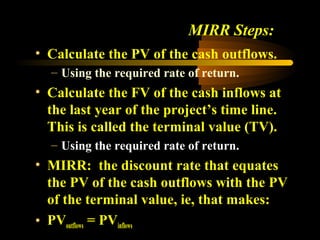

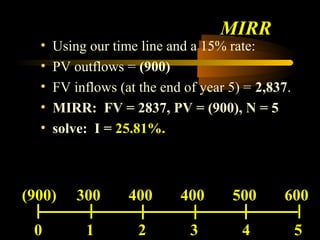

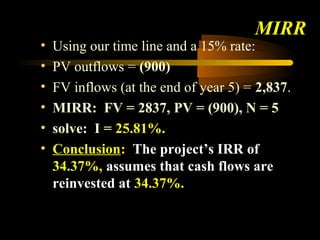

Capital budgeting is the process of planning for long-term investments. Key criteria for evaluating capital projects include payback period, net present value (NPV), internal rate of return (IRR), and profitability index (PI). NPV discounts future cash flows to determine if a project's value exceeds its cost. IRR is the discount rate that sets NPV to zero. PI is NPV divided by the initial investment. Multiple IRRs can occur if cash flows change signs more than once. The modified IRR (MIRR) assumes reinvestment at the required rate of return rather than the IRR.