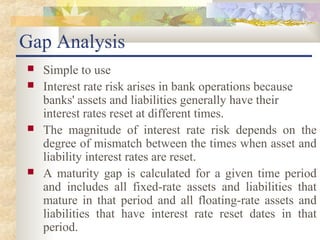

This document provides an overview of asset liability management (ALM) and hire-purchase agreements. It defines ALM as a technique to manage risks and earn returns by balancing assets and liabilities. Key aspects of ALM include measuring interest rate, credit, and liquidity risks. Models for ALM include gap analysis, duration gap analysis, VAR, and simulation. Hire-purchase agreements conditionally sell goods, allowing buyers to hire goods and later purchase them by installments. The document outlines rights and obligations of hirers and owners under such agreements.