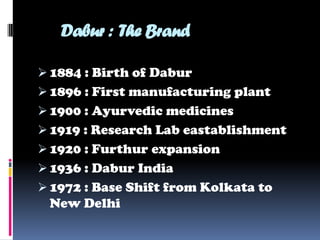

This document summarizes information about Dabur, an Indian consumer goods company. It lists the team members working on the project and provides a timeline of Dabur's history from 1884 to the present. It describes Dabur's current position as the 4th largest FMCG company in India with a portfolio of brands. It also outlines Dabur's product offerings, SWOT analysis, restructuring process, new branding and marketing strategies, and vision to double sales by 2014.