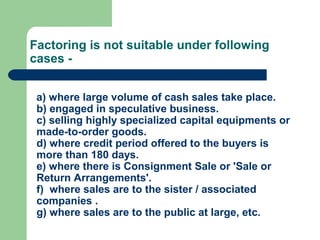

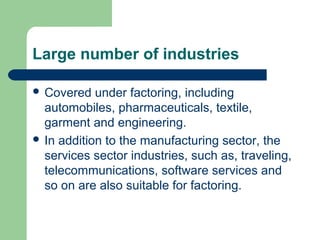

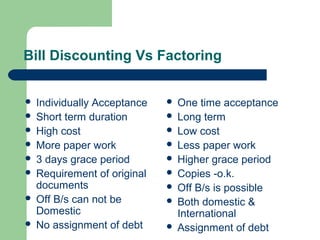

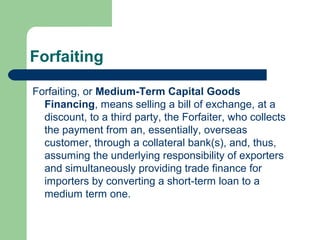

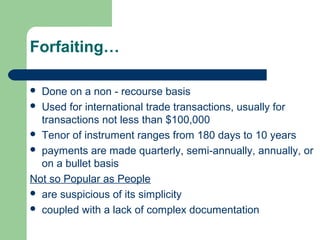

Bill discounting allows banks to purchase bills or notes from customers before their maturity and credit the discounted value to the customer's account. It provides working capital financing to the customer. Factoring involves the ongoing assignment of accounts receivable invoices from a client to a factoring company, which provides working capital financing, invoice collection services, and accounts receivable management. Forfaiting involves the discounted purchase of medium-term bills of exchange associated with international trade transactions by a forfaiter, typically with tenors of 6 months to 10 years.