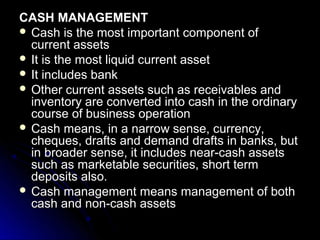

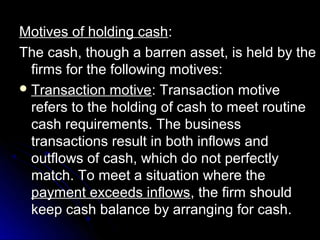

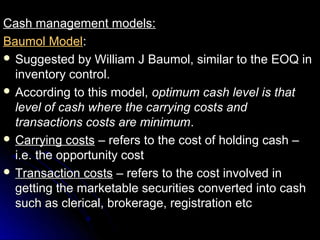

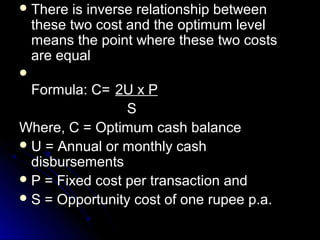

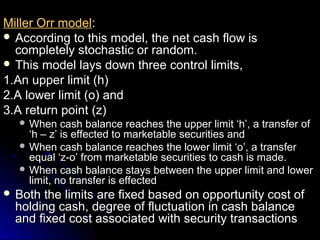

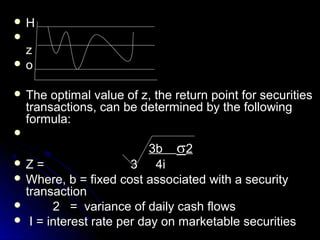

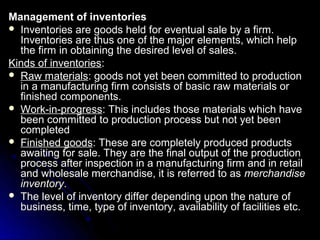

The main components of working capital are cash, receivables, and inventory. Cash is the most liquid current asset and includes funds held in bank accounts. Firms hold cash for transactional, precautionary, and speculative motives. The objectives of cash management are to maintain an optimal cash balance to meet payment obligations while minimizing costs. Common cash management strategies involve maintaining minimum cash levels, controlling cash inflows and outflows, and investing cash surpluses. Proper inventory management also aims to balance holding sufficient stock without excessive investment.