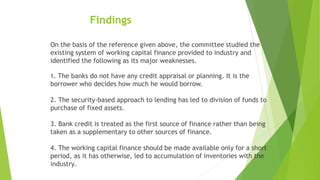

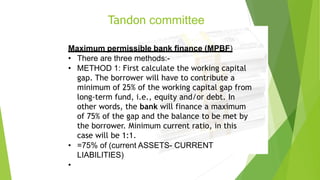

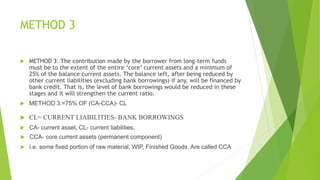

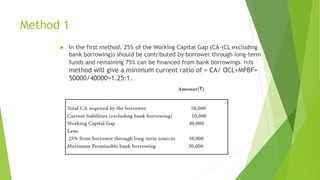

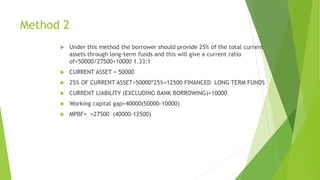

The Tandon Committee was appointed in 1974 by the Reserve Bank of India to frame guidelines for bank credit and oversight. Some key recommendations included introducing the concept of maximum permissible bank finance (MPBF) to determine how much working capital banks could finance. The committee outlined three methods for calculating MPBF that progressively reduced banks' involvement in financing current assets. It also made recommendations regarding the style of credit and information reporting systems to improve oversight of credit use.