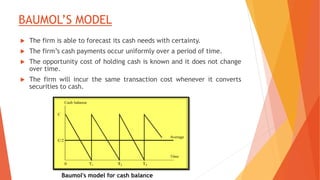

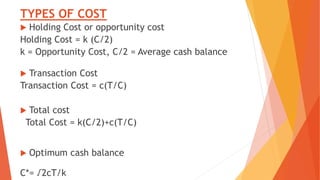

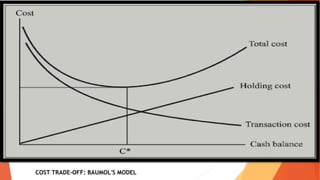

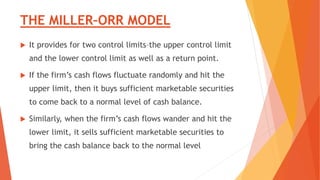

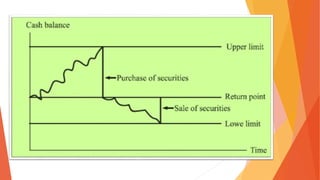

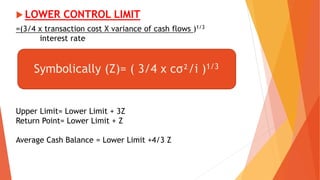

This document discusses cash management. It defines cash and describes the goals of cash management as managing cash flows, maintaining optimal cash balances, and investing surplus cash. It outlines factors that influence a firm's cash holdings such as transaction, precautionary, and speculative motives. Methods of cash forecasting and models for determining optimal cash balances are presented, including the Baumol and Miller-Orr models. Techniques for accelerating cash collections and controlling disbursements are also summarized.