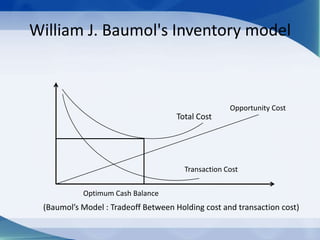

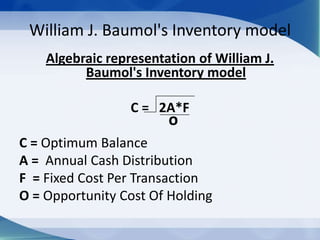

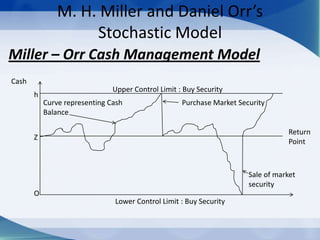

This document discusses two cash management models: William J. Baumol's inventory model and M. H. Miller and Daniel Orr’s stochastic model. Baumol's model determines optimal cash balance by minimizing holding and transaction costs under certainty. Miller and Orr's model accounts for stochastic cash flows by setting upper and lower control limits for cash balances and buying/selling securities as needed. Both models aim to help companies manage cash balances efficiently.