Cash Management in Financial Management

Definition:

Cash management refers to the process of collecting, handling, and utilizing cash efficiently to ensure an organization has sufficient liquidity to meet short-term obligations while optimizing cash flow. It involves managing cash inflows and outflows, maintaining liquidity, and minimizing idle cash to maximize profitability.

1. Importance of Cash Management

Effective cash management is essential for:

Liquidity Maintenance: Ensuring sufficient cash for daily operations.

Profit Maximization: Avoiding idle cash and investing surplus funds.

Debt Management: Ensuring timely repayment of loans and interest.

Business Stability: Avoiding financial distress and ensuring smooth operations.

Operational Efficiency: Managing working capital effectively.

2. Objectives of Cash Management

Ensure Liquidity: Maintain adequate cash to meet financial obligations.

Optimize Cash Flow: Regulate inflows and outflows to prevent shortages.

Reduce Idle Cash: Invest surplus cash to generate returns.

Minimize Transaction Costs: Reduce bank fees and interest expenses.

Enhance Profitability: Efficiently allocate cash for investment opportunities.

3. Components of Cash Management

a) Cash Inflows (Sources of Cash)

Sales revenue (cash and credit sales).

Accounts receivable collections.

Investment income (dividends, interest).

Loan proceeds and capital infusion.

b) Cash Outflows (Uses of Cash)

Operating expenses (salaries, rent, utilities).

Payments to suppliers and creditors.

Loan repayments and interest payments.

Dividend payments to shareholders.

4. Cash Management Strategies

a) Cash Budgeting

Forecasts future cash inflows and outflows.

Helps in planning for liquidity needs and investment decisions.

b) Accelerating Cash Inflows

Offering discounts for early payments.

Implementing efficient billing and collection processes.

Using electronic payment systems for faster transactions.

c) Delaying Cash Outflows

Negotiating longer payment terms with suppliers.

Avoiding early payments unless necessary.

Using credit facilities to manage short-term cash needs.

d) Maintaining Optimal Cash Reserves

Keeping enough cash to handle emergencies.

Avoiding excessive cash holdings that could be invested elsewhere.

e) Investing Surplus Cash

Investing in short-term securities like treasury bills and money market funds.

Earning interest on idle cash instead of keeping it in low-interest accounts.

5. Cash Management Techniques

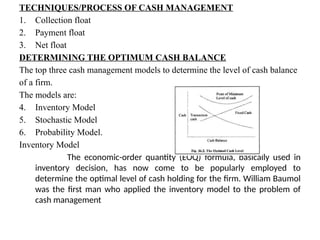

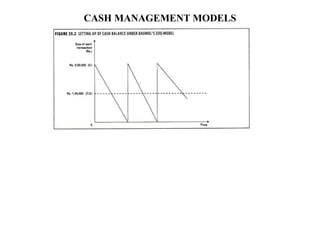

Economic Order Quantity (EOQ): Determines the optimal order quantity to reduce holding costs.

Float Management: Reducing time gaps between cash inflows and outflows.

Zero Balance Account (ZBA): Transfers excess funds to an investment account to maximize returns.

Lockbox System: Accelerates receivables collection by using bank services.

Cash Flow Forecasting: Predicting future cash requirements to avoid shortages.

Conclusion:

Efficient cash management ensures financial stability, optimizes liquidity, and maximizes business