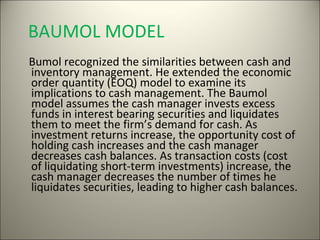

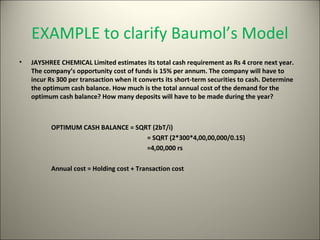

The document discusses cash management. It defines cash and describes cash management as managing cash flows in and out of a firm, within a firm, and cash balances. There are four facets of cash management: cash planning, managing cash flows, optimal cash level, and investing surplus cash. Firms hold cash for transaction, precautionary, speculative, and compensating motives. The objectives of cash management are to meet payment schedules and minimize idle cash. Methods to manage cash include accelerating collections and controlling disbursements. The Baumol and Miller-Orr models provide frameworks for determining optimal cash levels.