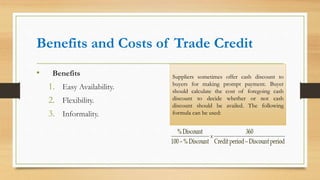

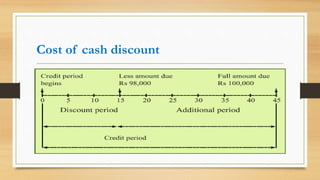

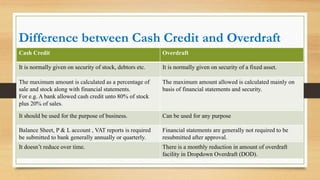

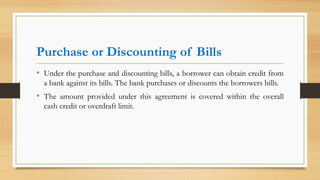

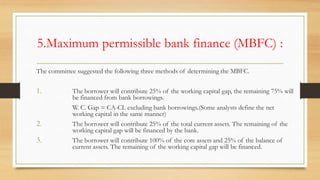

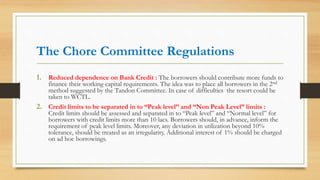

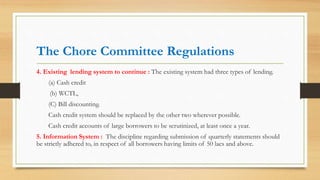

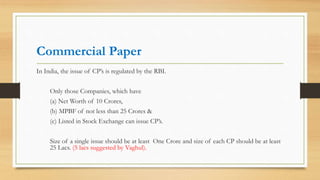

Working capital represents a company's short-term liquidity and is used to finance day-to-day operations. The two main sources of working capital finance are trade credit and bank borrowing. Trade credit involves suppliers extending credit to customers, and is an important source of financing especially for small businesses. Banks provide working capital financing through various facilities like overdrafts, cash credits, bill discounting, and loans. Banks follow guidelines from committees like Tandon and Chore to regulate working capital lending and ensure prudent financing.