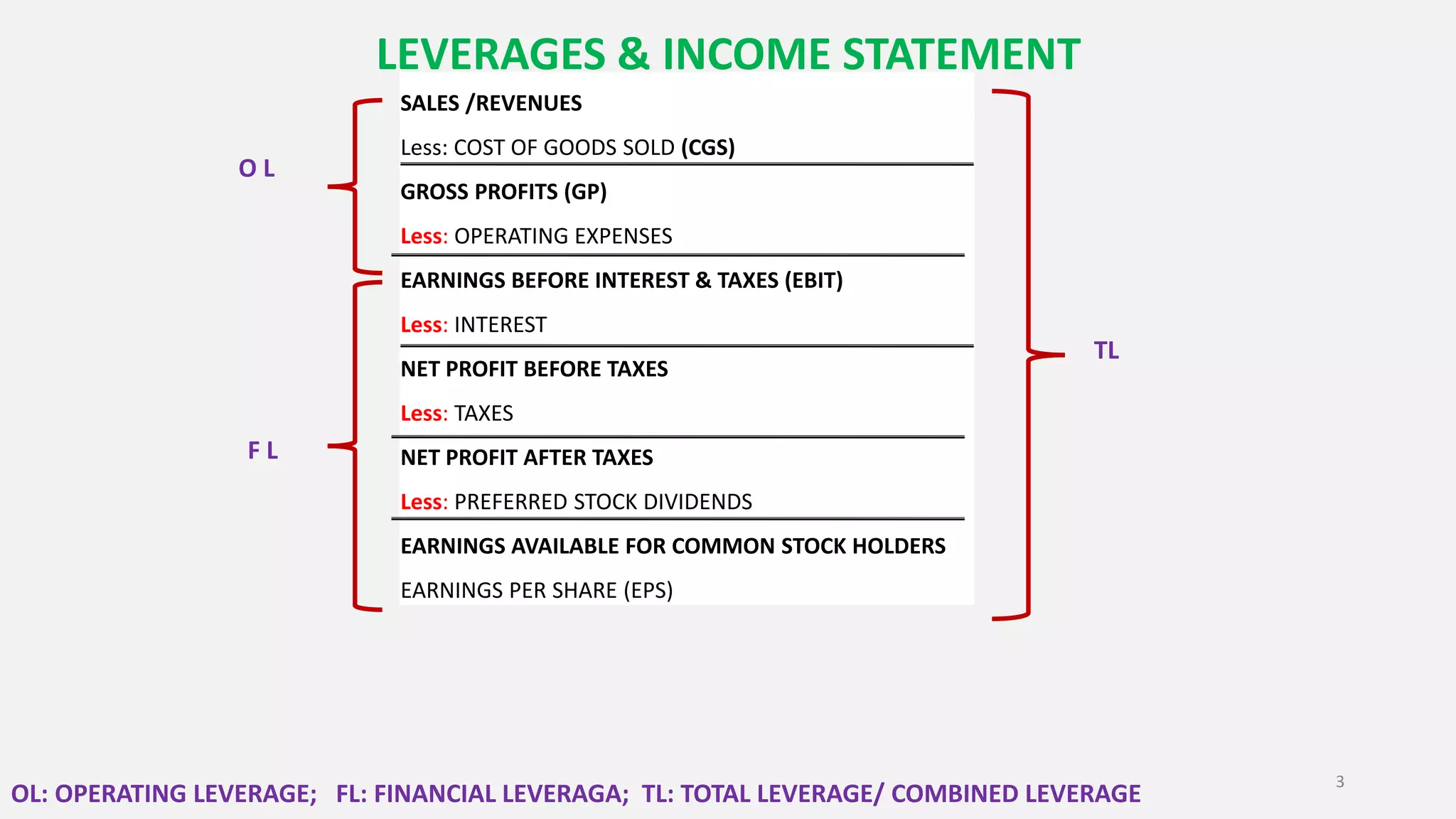

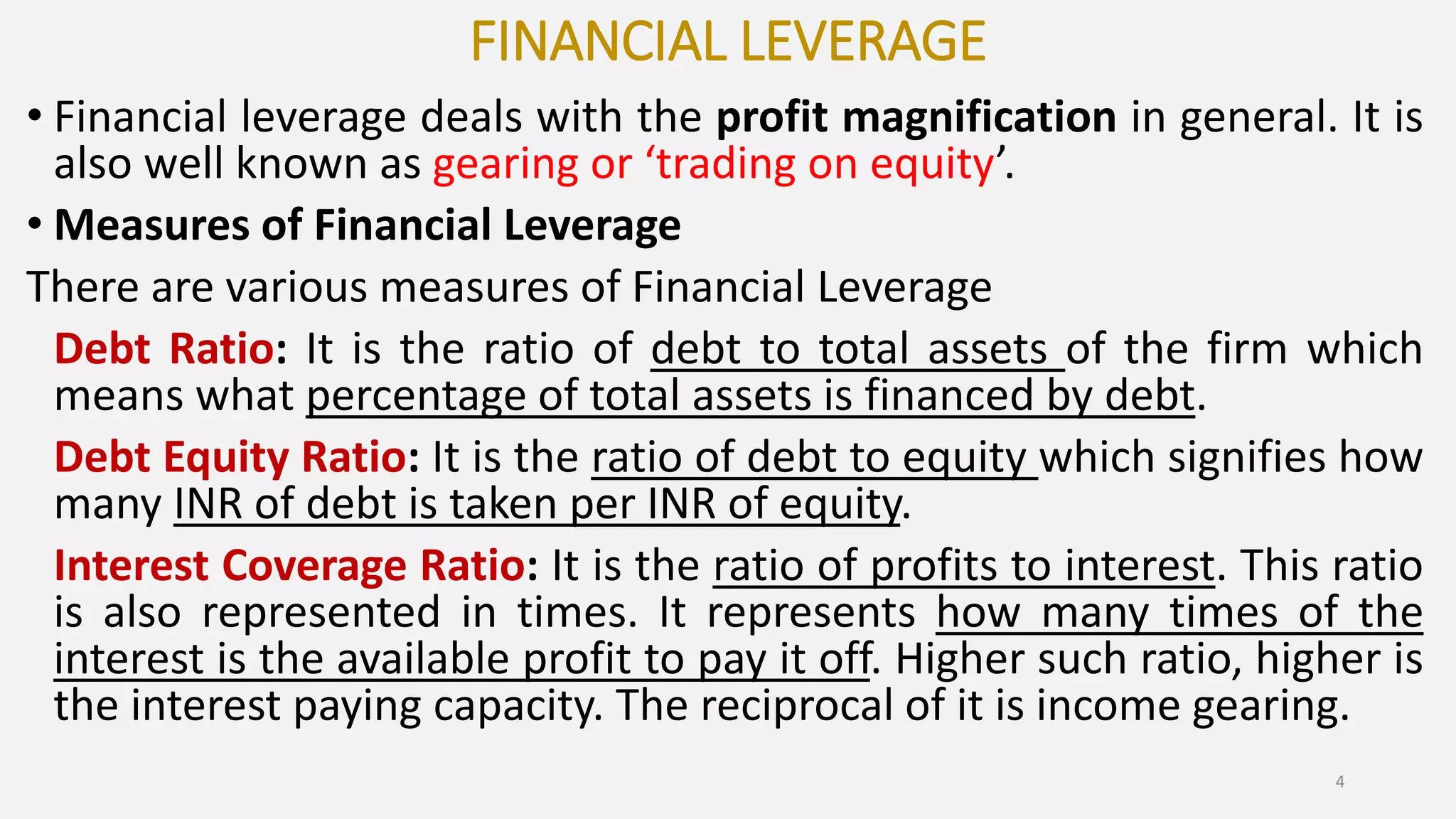

The document discusses different types of leverage used by firms, including financial leverage, operational leverage, and combined leverage. Financial leverage refers to the use of debt in a firm's capital structure, with measures including debt ratio and interest coverage ratio. Operational leverage refers to the use of fixed operating costs. Combined leverage shows the relationship between revenue, sales, and taxable income, and is calculated as the product of financial leverage and operational leverage. The document also provides examples of how different types of leverage are used in income statements and to amplify the effects of changes in sales, costs, and profits.