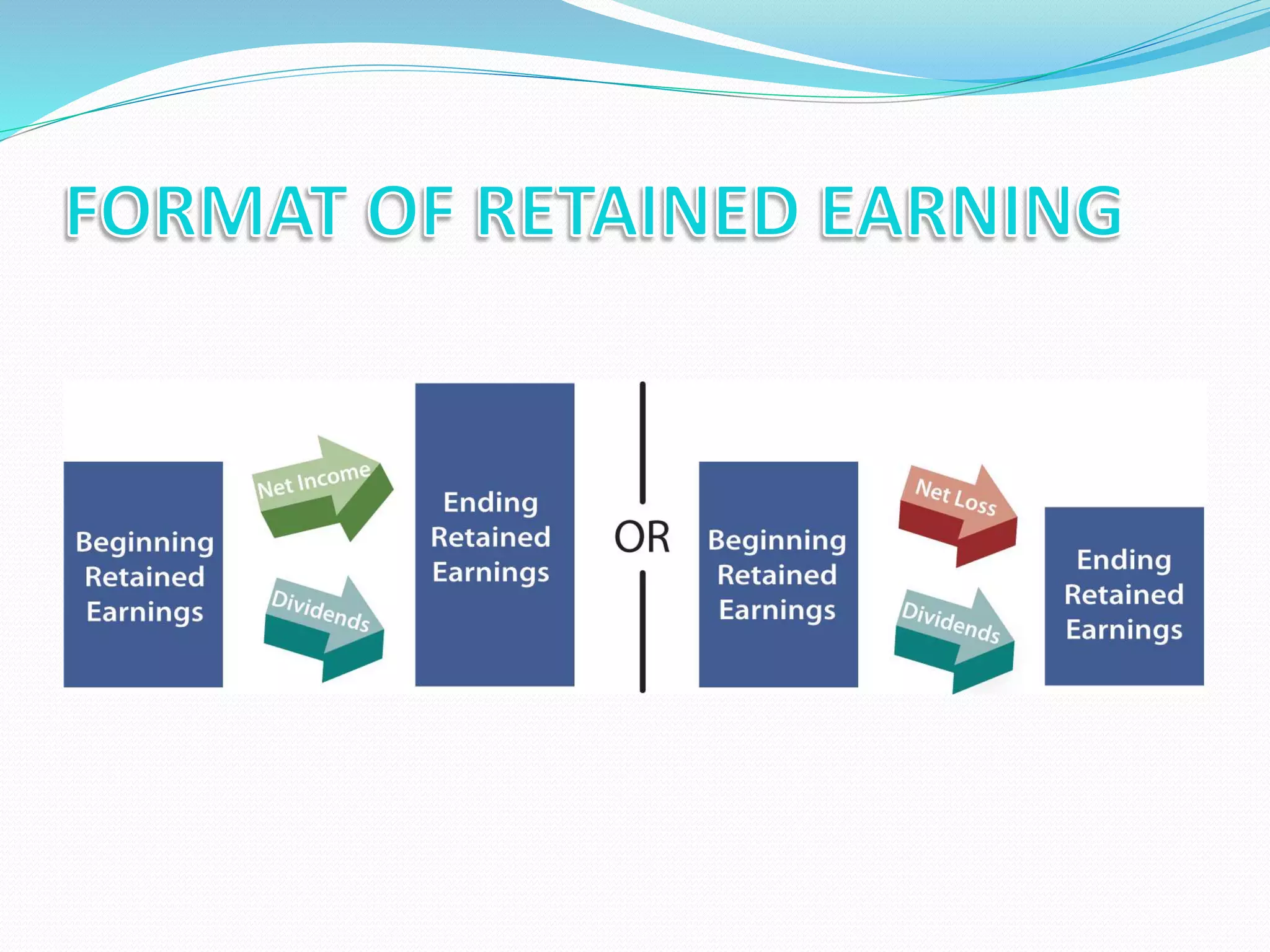

The document defines retained earnings as a statement showing how much of a firm's earnings were retained rather than paid out as dividends. The retained earnings statement reconciles the beginning and ending balances by showing increases from net income and decreases from dividends paid. Retained earnings are accumulated for purposes like funding fixed asset investments and meeting working capital needs. The calculation takes the beginning retained earnings, adds net income, and subtracts dividends paid to arrive at the ending retained earnings balance.