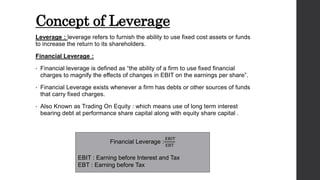

The document discusses various concepts related to corporate finance and leverage. It defines financial leverage as using fixed financial charges to magnify the effects of changes in EBIT on earnings per share. It also defines operating leverage as a company's ability to use fixed operating costs to magnify the effects of sales changes on earnings before interest and taxes. Combined leverage is when a company uses both financial and operating leverage to magnify changes in sales into larger changes in earnings per share. The document also discusses capital structure theories including the net income approach, traditional approach, and Modigliani-Miller approach.