The document discusses capital budgeting, which refers to a company's process of making investment decisions in long-term assets or projects. It covers the objectives, types, and process of capital budgeting decisions. Some key points:

- Capital budgeting decisions are among the most important financial decisions as they impact a company's future profitability and growth.

- The capital budgeting process involves generating investment proposals, estimating cash flows, evaluating proposals using methods like NPV or IRR, selecting projects, and reviewing projects after completion.

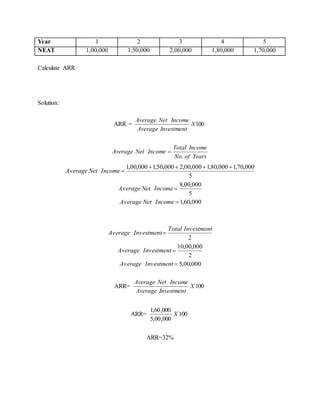

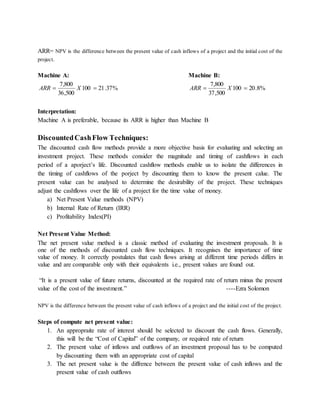

- Traditional methods like payback period and accounting rate of return do not consider the time value of money, while modern discounted cash flow methods like NPV and IRR do.