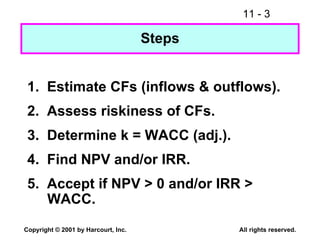

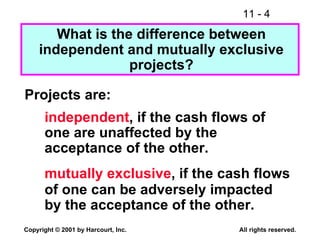

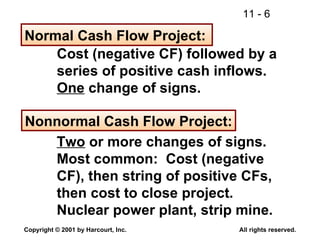

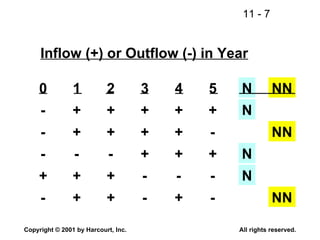

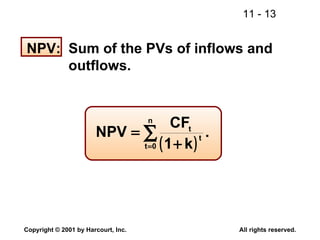

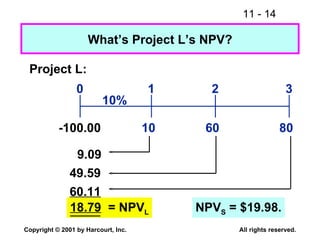

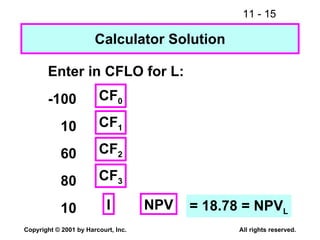

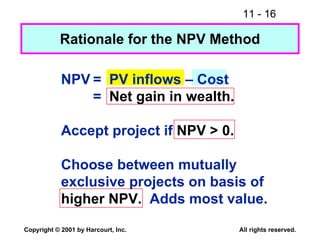

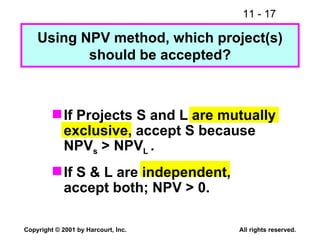

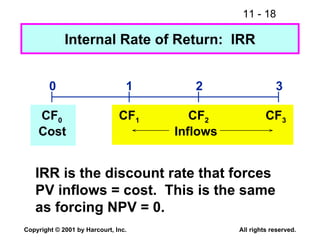

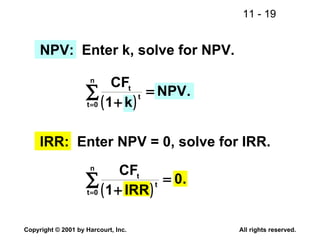

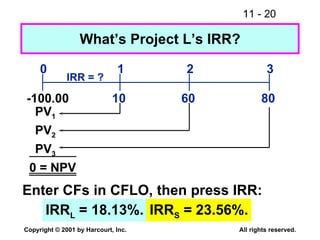

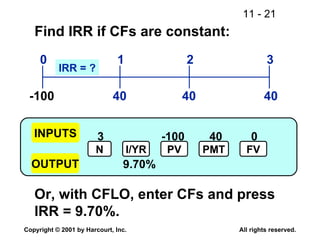

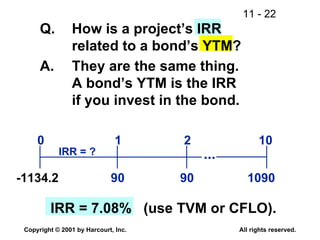

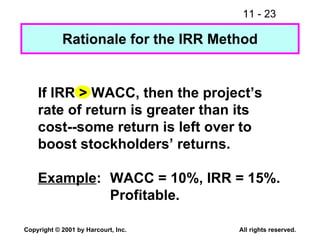

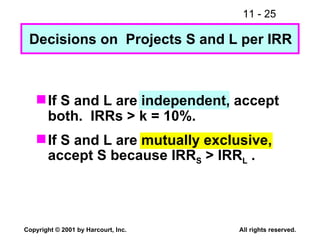

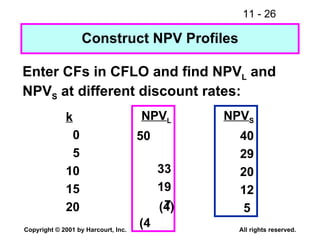

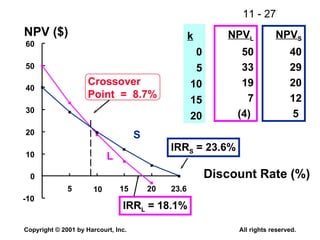

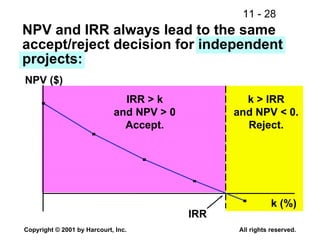

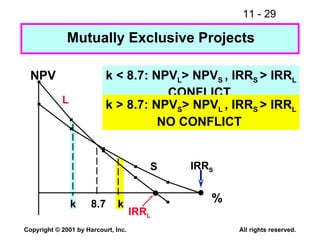

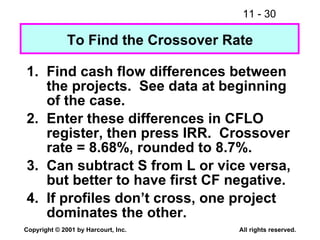

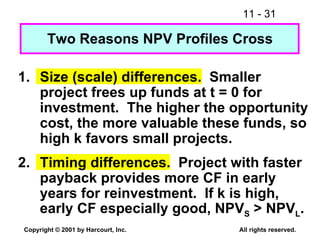

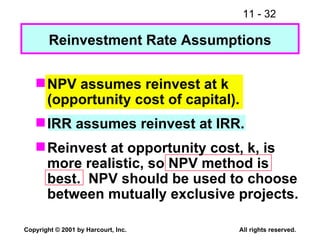

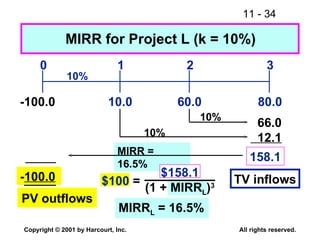

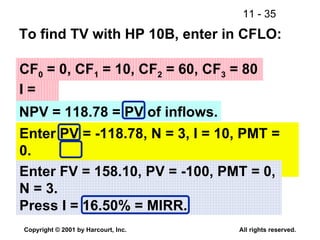

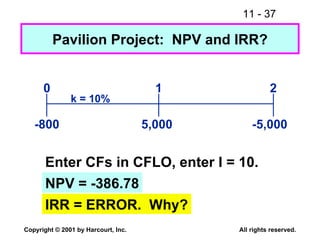

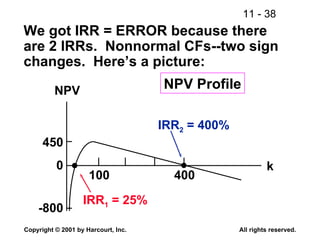

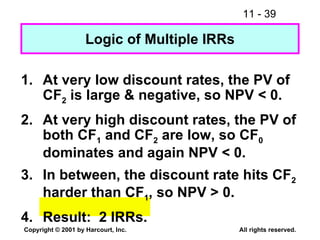

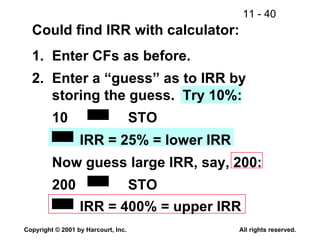

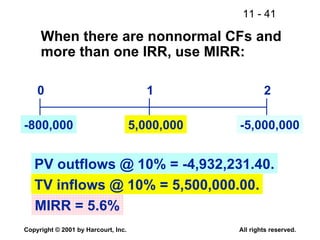

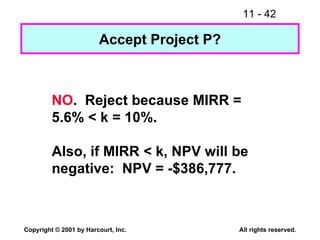

The document discusses capital budgeting and methods for evaluating investment projects such as net present value (NPV) and internal rate of return (IRR). It explains that NPV is the best method for choosing between mutually exclusive projects as it accounts for the time value of money and assumes cash flows are reinvested at the opportunity cost of capital. The document also introduces the modified internal rate of return (MIRR) as an alternative to IRR that makes the same reinvestment rate assumption as NPV.