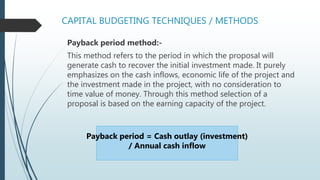

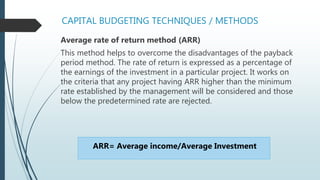

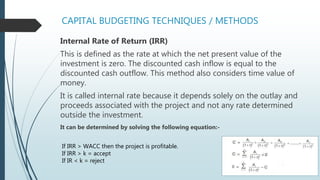

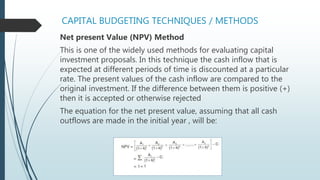

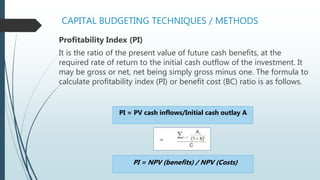

Capital budgeting is the process of planning long-term investments and allocating funds. It involves analyzing potential capital projects to determine which will be most profitable. Some key aspects of capital budgeting include evaluating projects based on cash flows rather than accounting profits, considering opportunity costs and tax implications, and ensuring project rates of return exceed the required cost of capital. Common techniques for evaluating projects include net present value analysis, internal rate of return, payback period, and profitability index. Capital budgeting helps firms make optimal investment decisions to maximize long-term value.