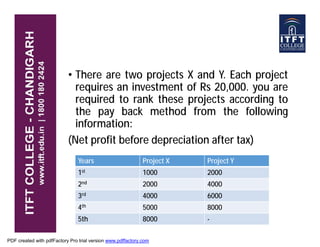

Capital budgeting refers to the process of evaluating investment opportunities in capital assets. It involves analyzing potential long-term investments and deciding which projects to undertake. The key methods discussed in the document are payback period, accounting rate of return, and net present value (NPV). Payback period only considers cash flows up to the point when initial costs are recovered, while accounting rate of return uses accounting profits over the full life but ignores timing of cash flows. NPV discounts all cash flows to the present using a discount rate, allowing for time value of money. Positive NPV projects that maximize shareholder wealth should be accepted.