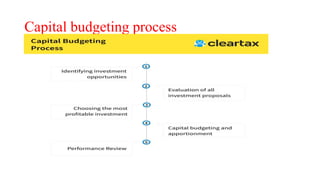

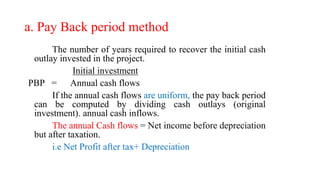

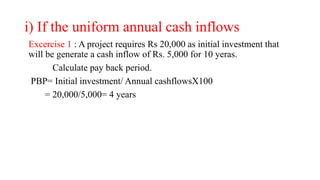

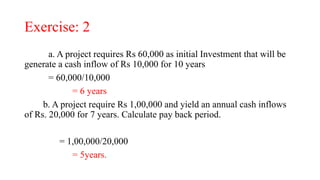

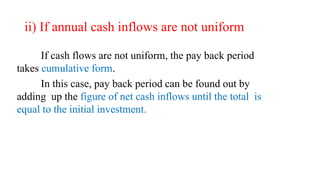

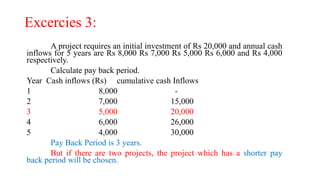

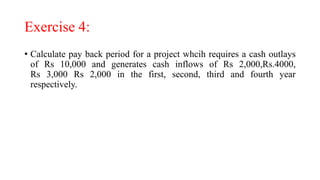

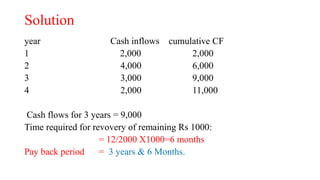

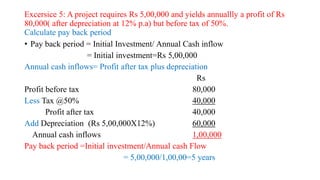

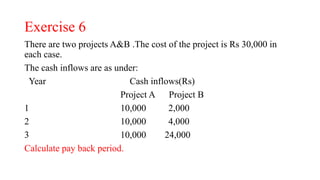

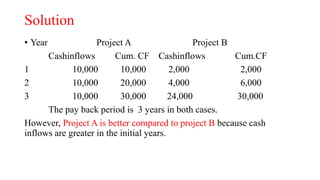

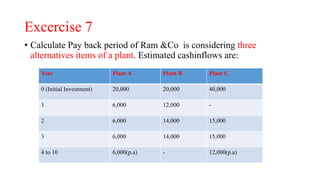

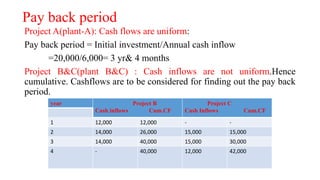

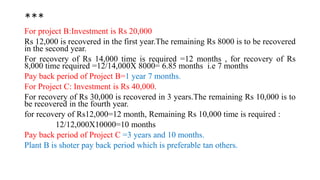

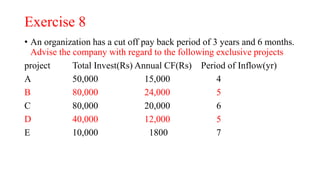

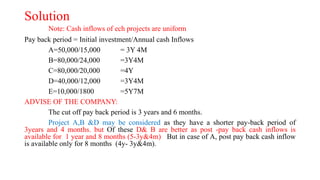

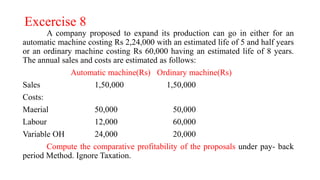

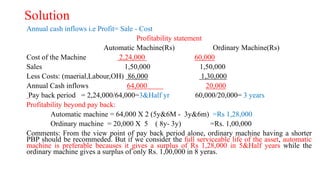

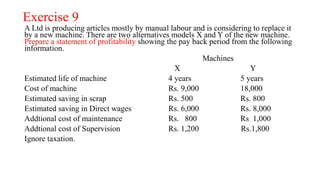

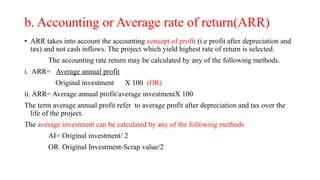

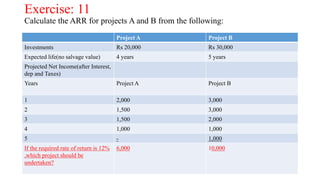

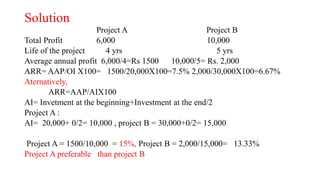

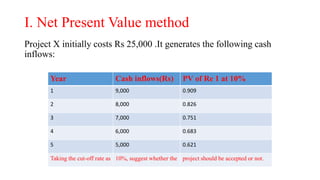

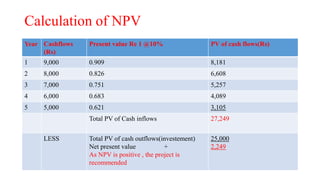

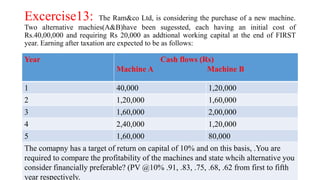

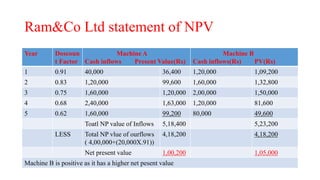

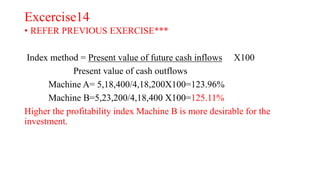

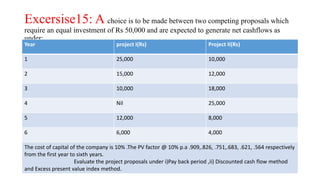

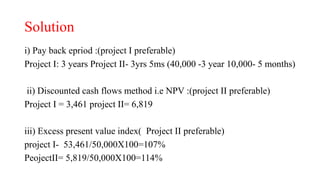

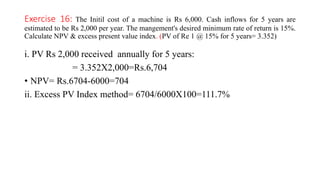

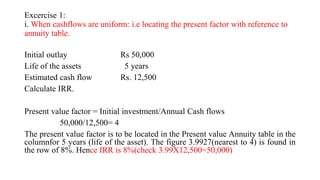

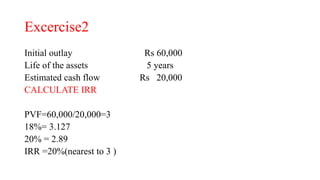

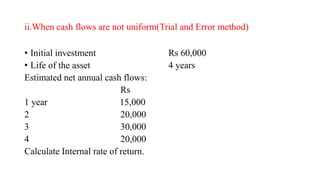

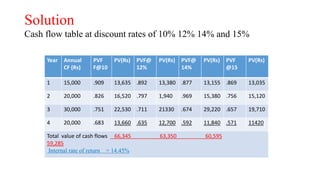

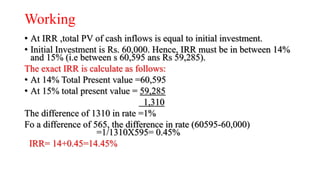

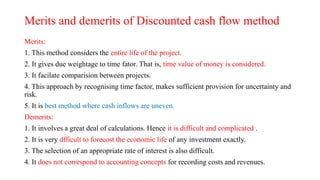

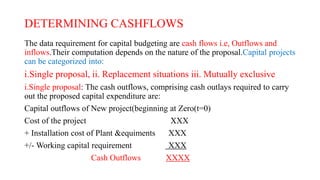

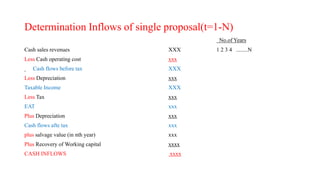

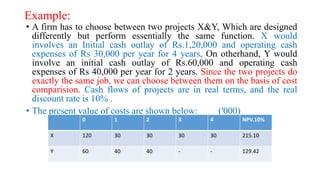

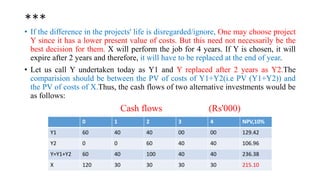

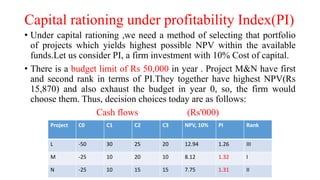

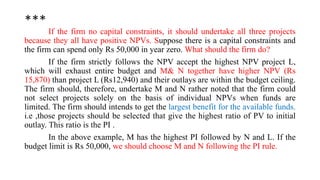

This document discusses capital budgeting and investment decision making. It begins by defining capital budgeting as the process of evaluating investment opportunities that require large capital outlays and have benefits received over many years in the future. The document then outlines the capital budgeting process, which includes identifying investment opportunities, evaluating proposals, selecting the most profitable project, allocating funding, and reviewing performance after completion. Finally, it discusses various methods that can be used to evaluate investment proposals, including payback period, accounting rate of return, net present value, and internal rate of return.