The document discusses capital budgeting and investment project evaluation. It defines capital budgeting as evaluating long-term investment proposals to maximize investor wealth. The key steps in the capital budgeting process are planning potential investments, evaluating proposals using techniques like NPV and IRR, selecting projects, implementing, controlling, and reviewing projects. Cash flows, including initial investments, interim cash flows, and terminal cash flows, are crucial to accurately evaluate projects. The document provides examples of calculating relevant cash flows for capital budgeting analysis.

![Investment Decisions 6.7

4. Post−tax Principle: Tax payments like other payments must be properly deducted in

deriving the cash flows. That is, cash flows must be defined in post-tax terms.

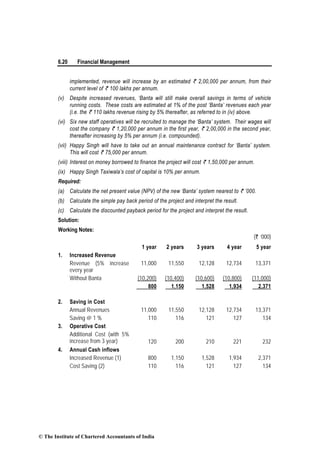

Illustration 1 : ABC Ltd is evaluating the purchase of a new project with a depreciable base of

` 1,00,000; expected economic life of 4 years and change in earnings before taxes and

depreciation of ` 45,000 in year 1, ` 30,000 in year 2, ` 25,000 in year 3 and ` 35,000 in year 4.

Assume straight-line depreciation and a 20% tax rate. You are required to compute relevant cash

flows.

Solution

`

Years

1 2 3 4

Earnings before tax and depreciation 45,000 30,000 25,000 35,000

Less: Depreciation 25,000 25,000 25,000 25,000

Earnings before tax 20,000 5,000 0 10,000

Less: Tax [@20%] 4,000 1,000 0 2,000

16,000 4,000 0 8,000

Add: Depreciation 25,000 25,000 25,000 25,000

Net Cash flow 41,000 29,000 25,000 33,000

Working Note:

Depreciation = ` 1, 00,000÷4

= ` 25,000

Illustration 2 : XYZ Ltd is considering a new investment project about which the following

information is available.

(i) The total outlay on the project will be ` 100 lacks. This consists of `60 lacks on plant

and equipment and `40 lacks on gross working capital. The entire outlay will be incurred

at the beginning of the project.

(ii) The project will be financed with `40 lacks of equity capital; `30 lacks of long term debt

(in the form of debentures); ` 20 lacks of short-term bank borrowings, and ` 10 lacks of

trade credit. This means that `70 lacks of long term finds (equity + long term debt) will

be applied towards plant and equipment (` 60 lacks) and working capital margin (`10

lacks) – working capital margin is defined as the contribution of long term funds towards

working capital. The interest rate on debentures will be 15 percent and the interest rate

on short-term borrowings will be 18 percent.

© The Institute of Chartered Accountants of India](https://image.slidesharecdn.com/19752ipccfmvol1cp6-130426033919-phpapp02/85/19752ipcc-fm-vol1_cp6-7-320.jpg)

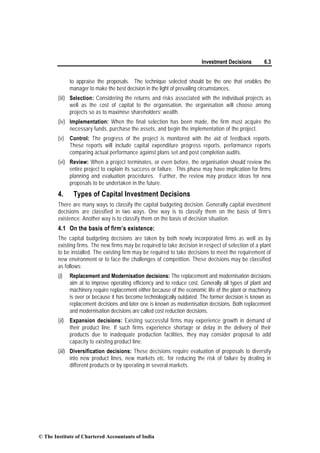

![6.8 Financial Management

(iii) The life of the project is expected to be 5 years and the plant and equipment would fetch

a salvage value of ` 20 lacks. The liquidation value of working capital will be equal to

`10 lacks.

(iv) The project will increase the revenues of the firm by ` 80 lacks per year. The increase in

operating expenses on account of the project will be `35.0 lacks per year. (This includes

all items of expenses other than depreciation, interest, and taxes). The effective tax rate

will be 50 percent.

(v) Plant and equipment will be depreciated at the rate of 331/3 percent per year as per the

written down value method. So, the depreciation charges will be :

` (in lacs)

First year 20.0

Second year 13.3

Third year 8.9

Fourth year 5.9

Fifth year 4.0

Given the above details, you are required to work out the post-tax, incremental cash flows

relating to long-term funds.

Solution

Cash Flows for the New Project

` (in lacs)

Years

0 1 2 3 4 5

(a) Plant and equipment (60.0)

(b) Working capital margin (10.0)

(c) Revenues 80.0 80.0 80.0 80.0 80.0

(d) Operating Costs 35.0 35.0 35.0 35.0 35.0

(e) Depreciation 20.0 13.33 8.89 5.93 3.95

(f) Interest on short-term bank borrowings 3.6 3.6 3.6 3.6 3.6

(g) Interest on debentures 4.5 4.5 4.5 4.5 4.5

(h) Profit before tax 16.90 23.57 28.01 30.97 32.95

(i) Tax 8.45 11.79 14.01 15.49 16.48

(j) Profit after tax 8.45 11.78 14.00 15.48 16.47

(k) Net salvage value of plant and equipment 20.0

(l) Net recovery working capital margin 10.0

(m) Initial Investment [(a) + (b)] (70.0)

© The Institute of Chartered Accountants of India](https://image.slidesharecdn.com/19752ipccfmvol1cp6-130426033919-phpapp02/85/19752ipcc-fm-vol1_cp6-8-320.jpg)

![Investment Decisions 6.9

(n) Operating cash inflows

[(j) +(e) + (g) (1–T)] 30.70 27.36 25.14 23.66 22.67

(o) Terminal cash flow

[(k) + (l) ] 30.00

(p) Net cash flow.

[(m) + (n) + (o) ] (70.0) 30.70 27.36 25.14 23.66 52.67

Working Notes (with explanations):

(i) The initial investment, occurring at the end of year 0, is ` 70 lacs. This represents the

commitment of long-term funds to the project. The operating cash inflow, relating to long-

term funds, at the end of year 1 is ` 30.7 lacs.

That is,

Profit after tax + Depreciation + Interest on debentures (1 – tax )

` 8.45 lacs + `20 lacs + ` 4.5 lacs (1 – 0.50)

The operating cash inflows for the subsequent years have been calculated similarly.

(ii) The terminal cash flow relating to long-term funds is equal to :

Net Salvage value of plant and equipment + Net recovery of working capital margin

When the project is terminated, its liquidation value will be equal to:

Net Salvage value of plant and equipment + Net recovery of working capital

The first component belongs to the suppliers of long-term funds. The second component

is applied to repay the current liabilities and recover the working capital margin.

7. Capital Budgeting Techniques

In order to maximise the return to the shareholders of a company, it is important that the best

or most profitable investment projects are selected. Because the results for making a bad

long-term investment decision can be both financially and strategically devastating, particular

care needs to be taken with investment project selection and evaluation.

There are a number of techniques available for appraisal of investment proposals and can be

classified as presented below:

© The Institute of Chartered Accountants of India](https://image.slidesharecdn.com/19752ipccfmvol1cp6-130426033919-phpapp02/85/19752ipcc-fm-vol1_cp6-9-320.jpg)

![Investment Decisions 6.15

an organization has incurred in raising funds or expects to incur in raising the funds needed

for an investment.

The net present value of a project is the amount, in current rupees, the investment earns after

yielding the desired rate of return in each period.

Net present value = Present value of net cash flow - Total net initial investment

The steps to calculating net present value are:-

1. Determine the net cash inflow in each year of the investment

2. Select the desired rate of return

3. Find the discount factor for each year based on the desired rate of return selected

4. Determine the present values of the net cash flows by multiplying the cash flows by the

discount factors

5. Total the amounts for all years in the life of the project

6. Lastly subtract the total net initial investment.

Illustration 6: Compute the net present value for a project with a net investment of ` 1, 00,000

and the following cash flows if the company’s cost of capital is 10%? Net cash flows for year one is

` 55,000; for year two is ` 80,000 and for year three is ` 15,000.

[PVIF @ 10% for three years are 0.909, 0.826 and 0.751]

Solution

Year Net Cash Flows PVIF @ 10% Discounted Cash

Flows

1 55,000 0.909 49,995

2 80,000 0.826 66,080

3 15,000 0.751 11,265

1,27,340

Total Discounted Cash Flows 1,27,340

Less: Net Investment 1,00,000

Net Present Value 27,340

Recommendation: Since the net present value of the project is positive, the company should

accept the project.

Illustration 7 : ABC Ltd is a small company that is currently analyzing capital expenditure

proposals for the purchase of equipment; the company uses the net present value technique to

evaluate projects. The capital budget is limited to 500,000 which ABC Ltd believes is the maximum

capital it can raise. The initial investment and projected net cash flows for each project are shown

below. The cost of capital of ABC Ltd is 12%. You are required to compute the NPV of the different

projects.

© The Institute of Chartered Accountants of India](https://image.slidesharecdn.com/19752ipccfmvol1cp6-130426033919-phpapp02/85/19752ipcc-fm-vol1_cp6-15-320.jpg)